Conventional asset allocation calls for investors to strategically sell stocks as they rise and buy stocks as they fall. This is in line with the Wall Street adage “Buy Low, Sell High.”

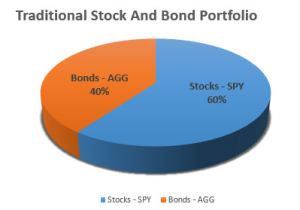

Consider, for example, a traditional stock and bond portfolio strategically allocated 60% to SPDR S&P 500 ETF SPY and 40% to the iShares Aggregate Bond ETF AGG. If SPY falls to 58% of the total portfolio, SPY is bought, and AGG is sold to rebalance the portfolio to a 60%/40% mix of stocks and bonds.

The trouble is that many investors cannot follow the precepts of conventional strategic asset allocation.

Some investors prefer to “buy and hold” stocks. These investors feel no need to rebalance. When stocks are going up, they see no reason to sell. When stocks are dropping, they prefer to hang on in anticipation of recovery.

Other investors feel compelled to sell (SELL!) when their stocks go down. These investors exhibit a dynamic risk tolerance. Their tolerance for risk increases when their stocks are rising and decreases when their stocks are falling. These investors should consider pursuing a disciplined strategy of trend-following and stop-loss portfolio insurance.

In Dynamic Strategies for Asset Allocation, William Sharpe makes the case that there is no best asset allocation strategy among these three alternatives:

- Buy and Hold.

- Conventional – buy when stocks fall; sell when stocks rise.

- Trend following – buy when stocks rise; sell when stocks fall.

In Sharpe’s nomenclature, trend-following is “portfolio insurance.” The most profitable strategy of the three is unknown in advance and will depend on the sequence and distribution of stock market returns in the future.

Conventional asset allocation is a good fit for investors inclined to take profits when their stocks move higher and to “average down” in falling markets.

Buy-and-hold asset allocation is a proven money-making strategy for investors who feel comfortable with it.

For trend-following investors, Sharpe describes a complicated solution called Constant Proportion Portfolio Insurance, which includes floors, cushions, and multipliers related to an investor’s stated risk tolerance.

An alternative and simpler approach to portfolio insurance uses technical analysis. The relationship of a stock’s average price to its current market price is used to objectively define an uptrend or downtrend. When stocks fall into a downtrend, a stop-loss sell rule applies. Likewise, when an uptrend is established, a buy rule applies.

For more information on stop-loss portfolio insurance, see the Successful Portfolios presentation, Trend-following for Investors Seeking Lower Risk and Greater Returns.