Open an Account

Special Offer: Empower Your Wealth Journey-Partner with Successful Portfolios and Interactive Brokers. Let our seasoned professionals guide you in building a personalized investment portfolio aligned with your goals.

Actionable Wealth Building Insights, News, Tips & Tricks from our Certified Financial Planner (CFP) and Chartered Financial Analyst (CFA) pros.

SCHEDULE CONSULTATION TODAY

Special Offer: Empower Your Wealth Journey-Partner with Successful Portfolios and Interactive Brokers. Let our seasoned professionals guide you in building a personalized investment portfolio aligned with your goals.

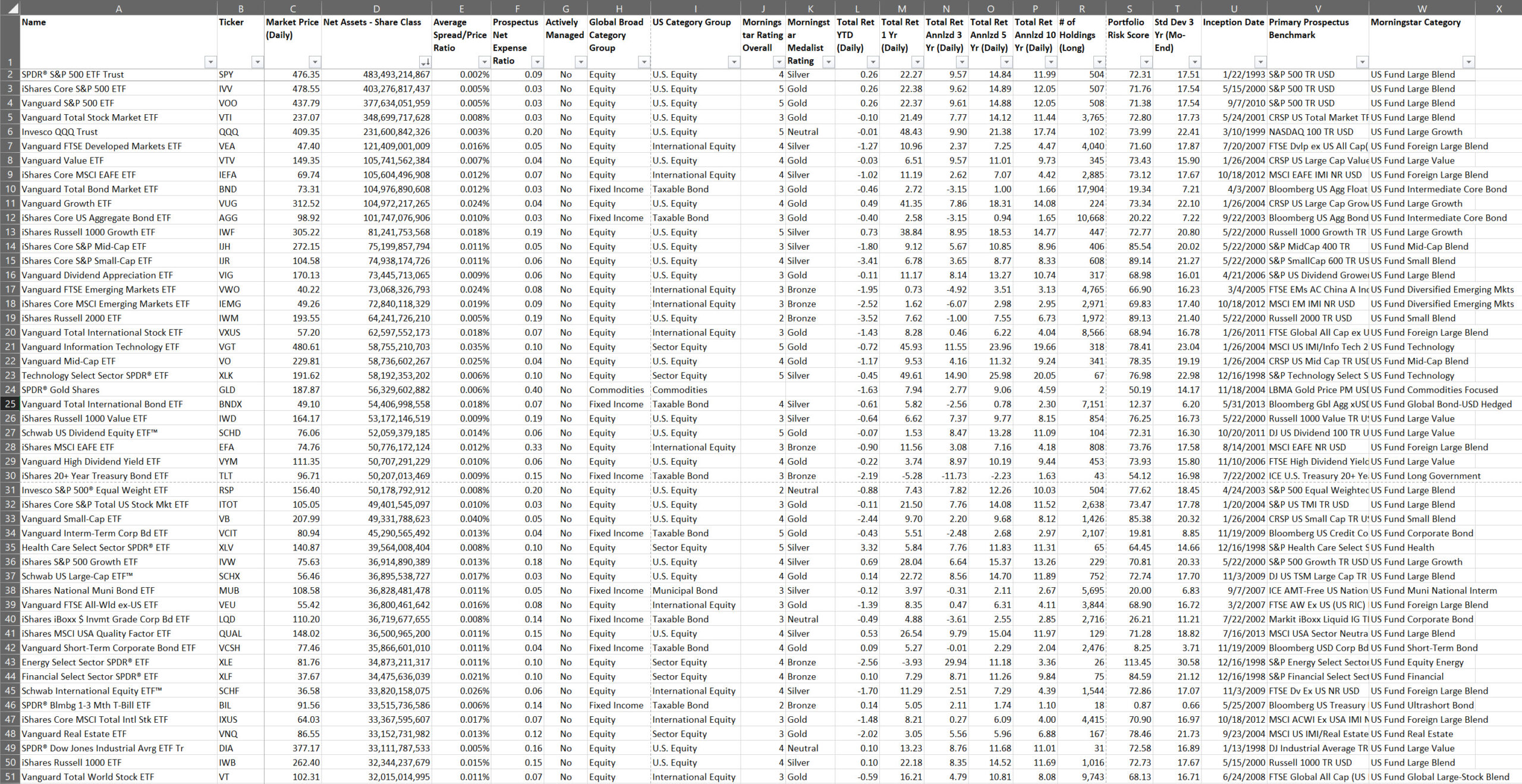

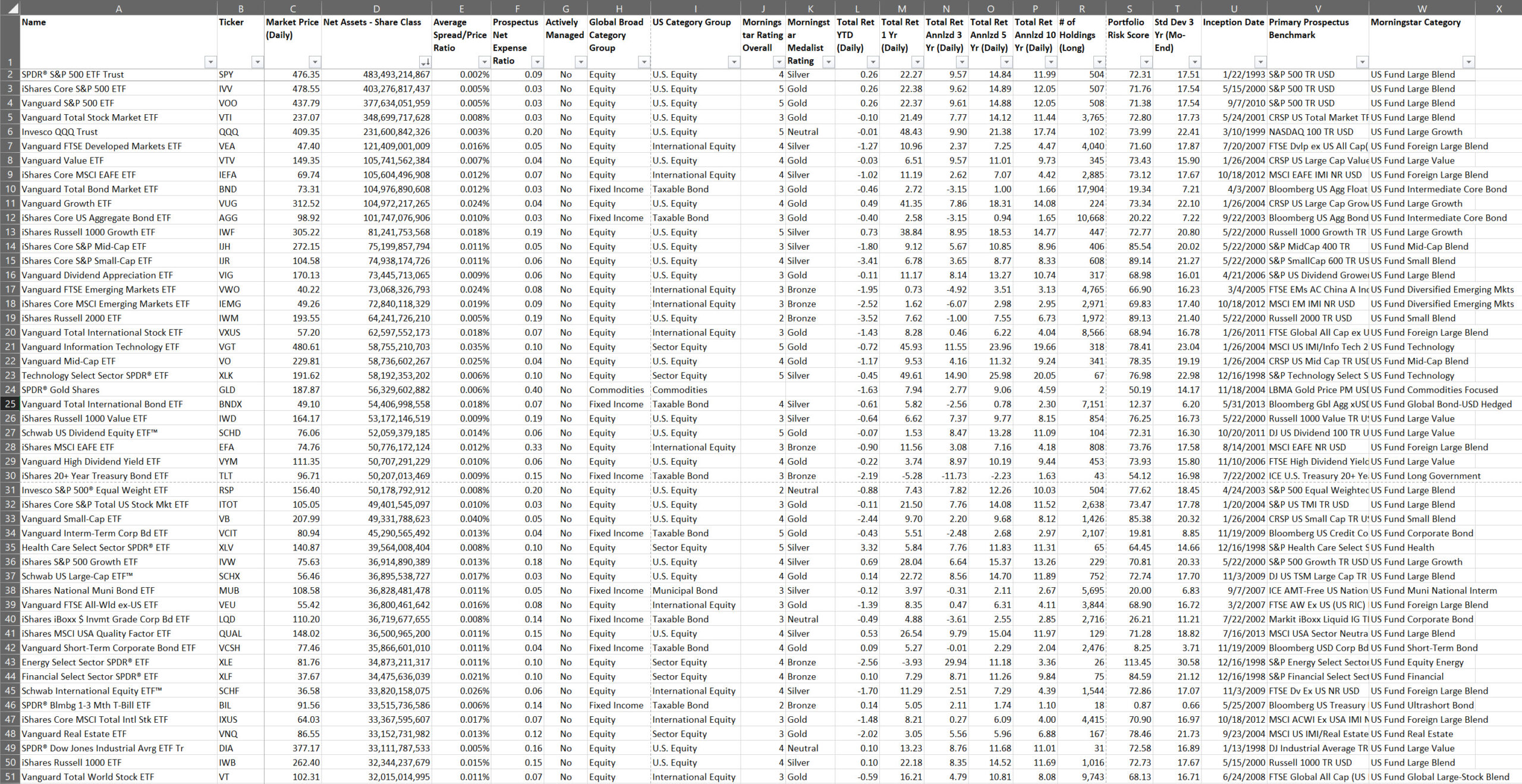

If you’re looking for a smart way to invest your money, exchange-traded funds (ETFs) might be your best bet. These investment vehicles offer a hassle-free and cost-effective way to access a diverse range of assets, including stocks, bonds, and alternative investments.

Two of the most popular alternative assets are gold and Bitcoin. While both are often touted as hedges against inflation and potential stores of value, they have distinct characteristics that set them apart. In this blog post, we will explore the key differences between gold and Bitcoin.

See a sample of Successful Portfolios recent tweets or posts on Twitter X.

Insights Inspired by Hemmingway’s “The Old Man and the Sea” and ChatGPT. Uncertainty is a constant companion. In the vast ocean of markets, adequate diversification and planning are essential.

Many investors focus solely on tax-advantaged retirement accounts like 401(k)s and IRAs when building their portfolios. However, non-qualified brokerage accounts can also provide significant tax benefits that are often overlooked. In this post, we’ll explore some of the key tax advantages of using a taxable brokerage account as part of your overall investment strategy.

The 2023 tax brackets and rates are now official. See how the new thresholds could affect your investment returns and retirement savings strategies this year.

The Customer Relationship Summary (CRS) is a new form that SEC-registered investment advisers (RIAs) and broker-dealers must provide to their clients and the public. This document is pivotal in ensuring transparency between financial professionals and their clients. The CRS is designed to help you, the investor, understand the nature of your relationship with your financial professional, the services they offer, the fees they charge, the conflicts of interest they face, and their disciplinary history.

Effective risk management is crucial for long-term portfolio success. This article outlines the top 20 investment risks that any serious money manager should know and understand, with examples and strategies for controlling and mitigating risk.

Planning for a Secure Retirement Planning for secure retirement can sometimes feel like navigating through a maze. Everyone dreams of a comfortable and secure retirement,

Special Offer: Empower Your Wealth Journey-Partner with Successful Portfolios and Interactive Brokers. Let our seasoned professionals guide you in building a personalized investment portfolio aligned with your goals.

If you’re looking for a smart way to invest your money, exchange-traded funds (ETFs) might be your best bet. These investment vehicles offer a hassle-free and cost-effective way to access a diverse range of assets, including stocks, bonds, and alternative investments.

Two of the most popular alternative assets are gold and Bitcoin. While both are often touted as hedges against inflation and potential stores of value, they have distinct characteristics that set them apart. In this blog post, we will explore the key differences between gold and Bitcoin.

See a sample of Successful Portfolios recent tweets or posts on Twitter X.

Insights Inspired by Hemmingway’s “The Old Man and the Sea” and ChatGPT. Uncertainty is a constant companion. In the vast ocean of markets, adequate diversification and planning are essential.

Many investors focus solely on tax-advantaged retirement accounts like 401(k)s and IRAs when building their portfolios. However, non-qualified brokerage accounts can also provide significant tax benefits that are often overlooked. In this post, we’ll explore some of the key tax advantages of using a taxable brokerage account as part of your overall investment strategy.

The 2023 tax brackets and rates are now official. See how the new thresholds could affect your investment returns and retirement savings strategies this year.

The Customer Relationship Summary (CRS) is a new form that SEC-registered investment advisers (RIAs) and broker-dealers must provide to their clients and the public. This document is pivotal in ensuring transparency between financial professionals and their clients. The CRS is designed to help you, the investor, understand the nature of your relationship with your financial professional, the services they offer, the fees they charge, the conflicts of interest they face, and their disciplinary history.

Effective risk management is crucial for long-term portfolio success. This article outlines the top 20 investment risks that any serious money manager should know and understand, with examples and strategies for controlling and mitigating risk.

Planning for a Secure Retirement Planning for secure retirement can sometimes feel like navigating through a maze. Everyone dreams of a comfortable and secure retirement,

Get an expertly tailored investment portfolio custom to your needs. Book a free consult to secure retirement income, reduce taxes, and safely grow wealth.

Get an expertly tailored investment portfolio custom to your needs. Book a free consult to secure retirement income, reduce taxes, and safely grow wealth.

Copyright© 2024 Successful Portfolios. Powered by PressGo Digital