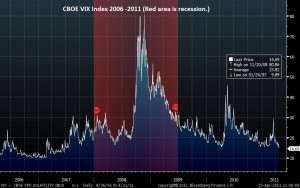

The VIX Index is a measure of market expectations for near-term stock price volatility derived from current market quotes on S&P 500 index options. The VIX is also known as the “Fear Index”. Watching the VIX allows professional portfolio managers to monitor the cost of principal-protecting a stock portfolio.

As you can see in the chart above, the VIX index (“fear!”) has receded to a post-recession low. This means portfolio insurance is currently relatively cheap. A recent article in Barron’s describes some practical ideas on how to capitalize on this fact:

If you are worried about the near future, buy puts to protect your stocks. (or) …think of selling some stock and replacing your shares with calls. You can use stock-replacement strategies to withdraw your initial investment and limit your risk. –Steven M. Sears

Successful Portfolios is adept at helping clients execute principal-protected investment strategies that avoid the high-costs and illiquidity of annuities and structured products.

Get an expertly tailored investment portfolio custom to your needs. Book a free consult to secure retirement income, reduce taxes, and safely grow wealth.

Get an expertly tailored investment portfolio custom to your needs. Book a free consult to secure retirement income, reduce taxes, and safely grow wealth.

Copyright© 2025 Successful Portfolios. Powered by PressGo Digital