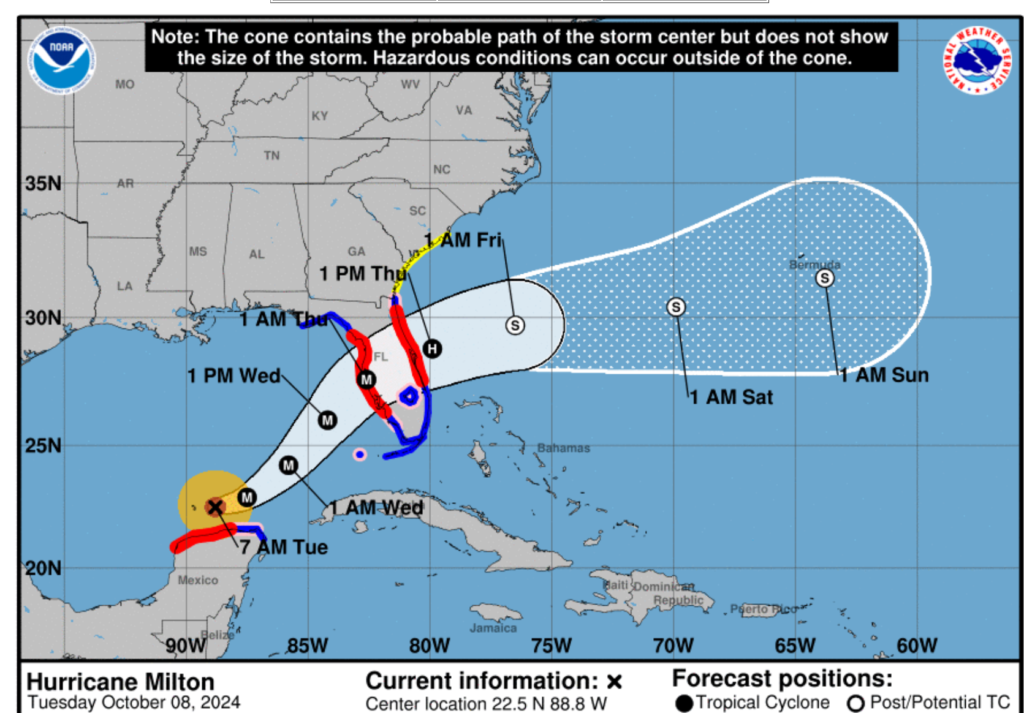

Business Continuity Plan

Successful Portfolios LLC has established a Business Continuity Plan (BCP) to prepare for business disruptions, including natural disasters like hurricanes. Our plan emphasizes flexibility, adaptability, redundancy, and protecting the interests of our clients. Read this for contact Information for our Clients in the Event of a Business Disruption.

Powerful Free Excel Tools for Income Tax Planning

Today, we highlight two excellent, free Excel-based income tax planning resources that we have used for many years to help our clients minimize or eliminate their tax liability: Geoff Mendal’s Income Tax Planning Excel Sheet and Glenn Reeves’ Excel 1040 Worksheet.

Understanding Investment Risk: The Key to Building Successful Portfolios

Imagine two investors: one cautiously watching their steady but insufficient gains, the other riding a rollercoaster of higher highs and lows. What’s the difference? Their understanding of investment risk. As a financial advisor with years of experience counseling investors, I’ve seen firsthand how grasping this concept can make or break portfolios and retirement nest eggs. Today, let’s demystify investment risk and explore why it’s crucial for achieving your financial goals.

Grable and Lytton Risk-Tolerance Questionnaire

Welcome to the Grable and Lytton Risk-Tolerance Questionnaire. This quick and easy quiz is designed to help you understand your financial risk tolerance. Knowing your risk tolerance is essential for making informed investment decisions that align with your comfort level and financial goals.

Once you complete the quiz, your score will be instantly calculated and shown to you, providing immediate insights into your risk tolerance profile.

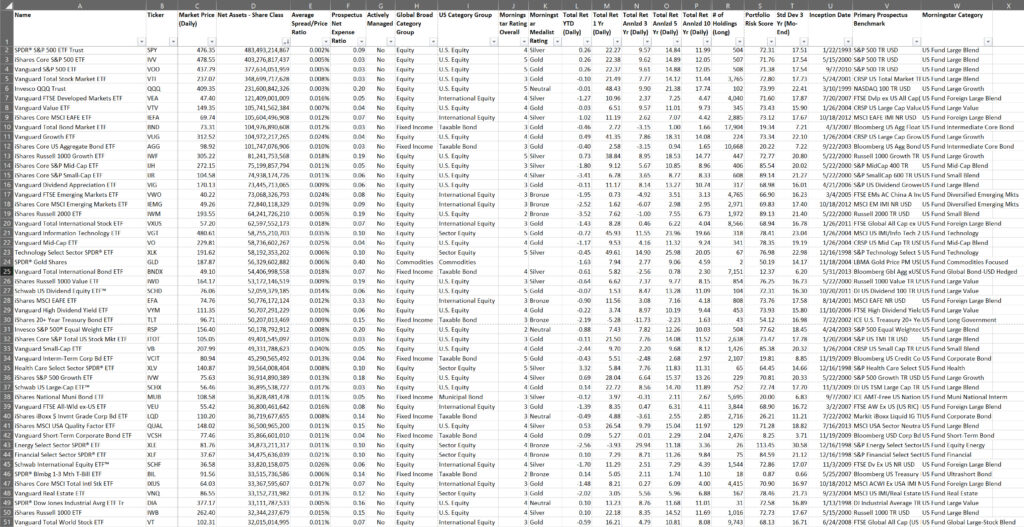

No-Overlap ETF Model Portfolios™

Our No-Overlap ETF Model Portfolios™ serve as investable benchmarks to help clients capture and compound long-term returns and compare the performance of various strategic asset allocations. We hand-pick an efficient mix of ETFs tracking key market sectors, ensuring diversification across thousands of securities without overlap. Our selections are ultra-low-cost and liquid, easy to buy or sell, and have a proven track record of best-in-class historical performance.

ETF Worksheet For 2024

If you’re looking for a smart way to invest your money, exchange-traded funds (ETFs) might be your best bet. These investment vehicles offer a hassle-free and cost-effective way to access a diverse range of assets, including stocks, bonds, and alternative investments.

Open an Account

Special Offer: Empower Your Wealth Journey-Partner with Successful Portfolios and Interactive Brokers. Let our seasoned professionals guide you in building a personalized investment portfolio aligned with your goals.

Bitcoin versus Gold

Two of the most popular alternative assets are gold and Bitcoin. While both are often touted as hedges against inflation and potential stores of value, they have distinct characteristics that set them apart. In this blog post, we will explore the key differences between gold and Bitcoin.

Twitter X

See a sample of Successful Portfolios recent tweets or posts on Twitter X.

The Purpose of Diversification

Imagine a fisherman setting out to sea, dreaming of catching the biggest fish of his life. He seeks a spectacular marlin and focuses all his resources and effort on catching it. It’s an exciting prospect, but it’s also incredibly risky. It brings to mind Hemingway’s The Old Man and the Sea. What if Santiagos’ marlin gets away? What if his boat sinks? Or what if he runs short of drinking water on his journey? Or what if his fish is nowhere to be found? This allegory captures the essence of investment diversification. You may have heard the age-old advice: “Cast a wide net.”…