Retirement Planning: Parker Evans, CFA, CFP Explains the 4% Rule

“The 4% spending rule states that retirees with a diversified portfolio split between stocks and bonds can safely withdraw 4% of their initial balance at retirement, adjusting the dollar amount for inflation each year thereafter.”

Reverse Mortgage – True or False Quiz

“For the average American couple at age 65, home equity makes up more than two-thirds of their total wealth, according to 2011 U.S. Census data. More specifically, the median net worth for married couples age 65 and older is $284,790. Of this amount, $192,552 is in home equity, and $92,238 is in non-equity assets, including […]

Ten Questions to Ask Your Financial Advisor (And Our Answers)

We recommend that you ask these 10 important questions before selecting a financial planner or investment advisor. Get your answers in writing.

SP’s Low Volatility Strategy: Snapshot of Account “BEC1” Investment Performance using IB Portfolio Analyst

Presented in the graphic shown below is the inception-to-date comparative performance of Successful Portfolios’ Low Volatility Investment Strategy (BEC1) and a blended index of 70% Vanguard Total World Stock Index ETF (VT) and 30% Vanguard Total Bond Market ETF (BND). We prepared this presentation using Interactive Brokers Portfolio Analyst.

SP’s Mean Reversion Strategy: Snapshot of Account “EC1” Investment Performance using IB Portfolio Analyst

We present the inception-to-date comparative performance of Successful Portfolios’ Mean Reversion Investment Strategy (EC1) and the Vanguard Total World Stock Index ETF (VT). We prepared the presentation using Interactive Brokers Portfolio Analyst.

Why Chose a Certified Financial Planner (CFP) Professional?

Learn What a Certified Financial Planner™ (CFP) Professional Can Do for You…

Why chose a Chartered Financial Analyst (CFA)?

Wealth Management Qualifications & Credibility. Here’s why you should chose a Chartered Financial Analyst (CFA)…

What is a SEC Form ADV Part 2 Brochure? Sounds boring but it’s not. It’s an informative Client Brochure.

If you do business with or are considering doing business with a Registered Investment Advisor Firm (RIA), that RIA should give your their official Form ADV Part 2 Brochure. It’s sometime referred to as the “Client Brochure”. You should read it. It’s a plain language disclosure document that the RIA must submit to the Securities and Exchange Commission (SEC) annually. Download Successful Portfolios April 2017 Client Brochure.

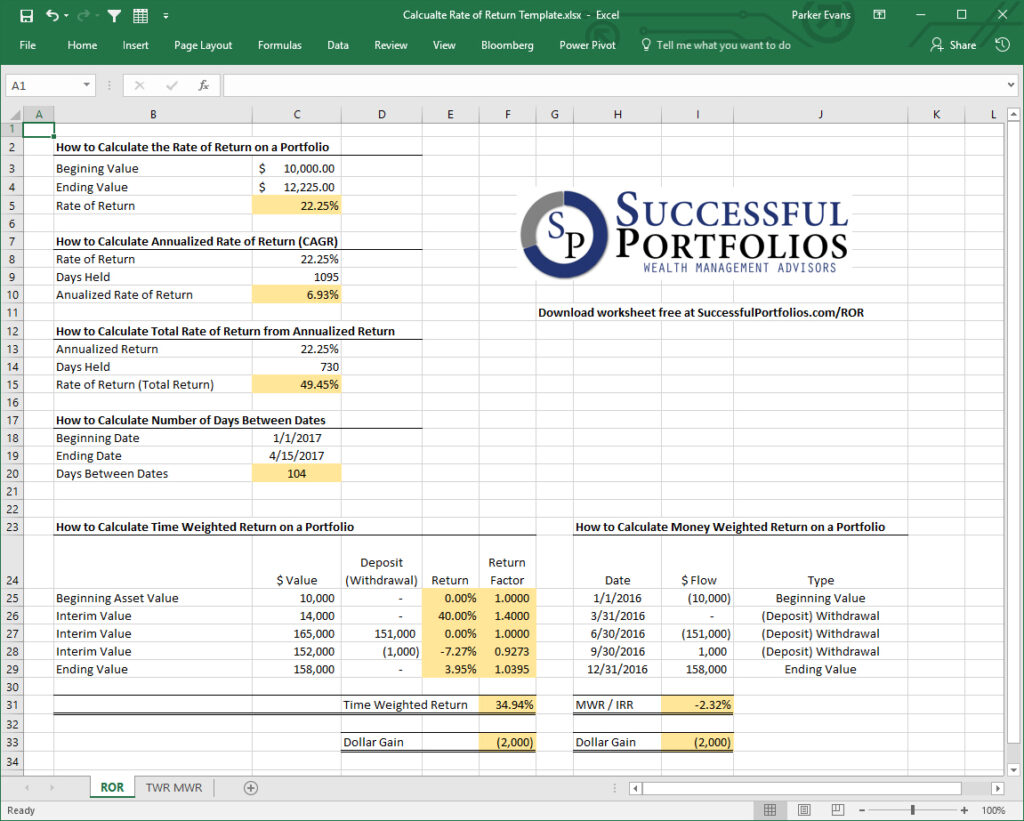

Learn How to Calculate the Rate of Return on Your Investment Portfolio or Any Other Asset: Free Excel Worksheet.

Learn how to use Excel to calculate: (1) Total Rate of Return (ROR) on an asset or portfolio; (2) Annualized Return (AR), Annualized Percentage Rate (APR), or Compound Annual Growth Rate (CAGR); (3) Total ROR from CAGR, APY or AR; (4) Number of days between dates; (5) Time Weighted Return (TWR); (6) Money Weighted Return (MWR) or Internal Rate of Return ((IRR).

What is a fee-only advisor?

The Certified Financial Planner Board of Standards, Inc. (CFP Board) definition of “fee-only” financial advisor reads: “A (CFP) certificant may describe his or her practice as “fee-only” if, and only if, all of the certificant’s compensation from all of his or her client work comes exclusively from the clients in the form of fixed, flat, hourly, percentage or performance-based fees.”