Ten Questions to Ask Your Financial Advisor (And Our Answers)

We recommend that you ask these 10 important questions before selecting a financial planner or investment advisor. Get your answers in writing.

Why Chose a Certified Financial Planner (CFP) Professional?

Learn What a Certified Financial Planner™ (CFP) Professional Can Do for You…

Why chose a Chartered Financial Analyst (CFA)?

Wealth Management Qualifications & Credibility. Here’s why you should chose a Chartered Financial Analyst (CFA)…

What is a SEC Form ADV Part 2 Brochure? Sounds boring but it’s not. It’s an informative Client Brochure.

If you do business with or are considering doing business with a Registered Investment Advisor Firm (RIA), that RIA should give your their official Form ADV Part 2 Brochure. It’s sometime referred to as the “Client Brochure”. You should read it. It’s a plain language disclosure document that the RIA must submit to the Securities and Exchange Commission (SEC) annually. Download Successful Portfolios April 2017 Client Brochure.

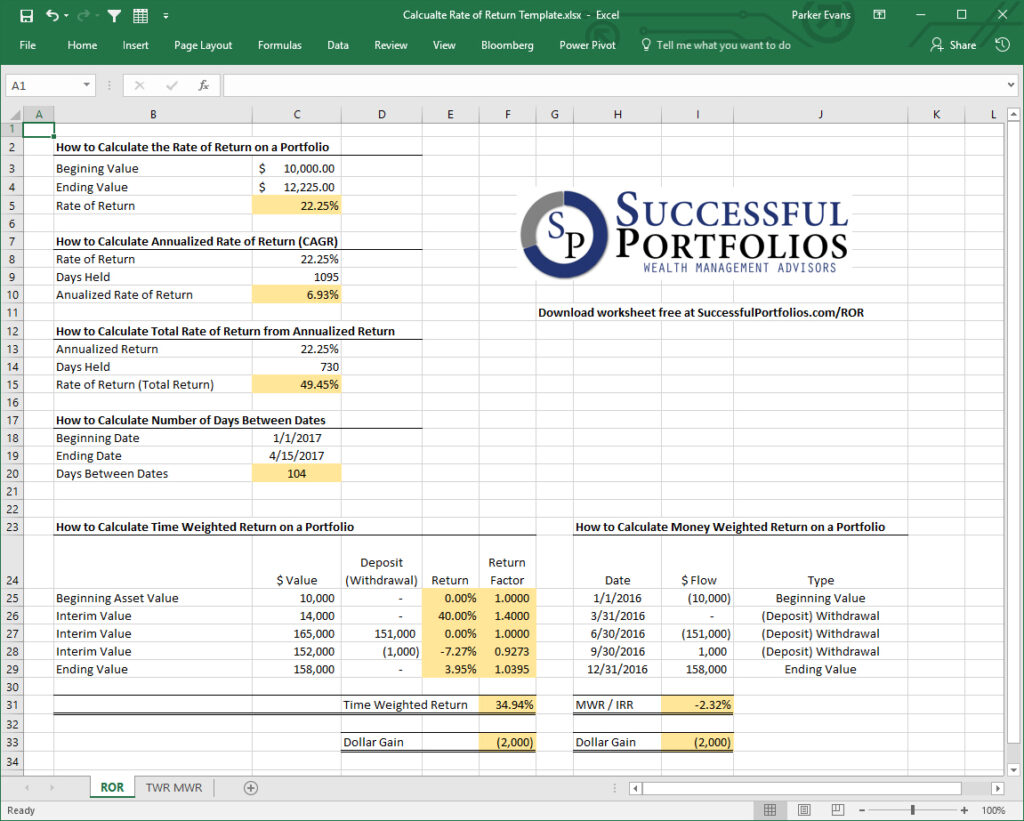

Learn How to Calculate the Rate of Return on Your Investment Portfolio or Any Other Asset: Free Excel Worksheet.

Learn how to use Excel to calculate: (1) Total Rate of Return (ROR) on an asset or portfolio; (2) Annualized Return (AR), Annualized Percentage Rate (APR), or Compound Annual Growth Rate (CAGR); (3) Total ROR from CAGR, APY or AR; (4) Number of days between dates; (5) Time Weighted Return (TWR); (6) Money Weighted Return (MWR) or Internal Rate of Return ((IRR).

What is a fee-only advisor?

The Certified Financial Planner Board of Standards, Inc. (CFP Board) definition of “fee-only” financial advisor reads: “A (CFP) certificant may describe his or her practice as “fee-only” if, and only if, all of the certificant’s compensation from all of his or her client work comes exclusively from the clients in the form of fixed, flat, hourly, percentage or performance-based fees.”

Certified Financial Planner (CFP): Experience and Knowledge to Help Clients Succeed

What does a Certified Financial Planner (CFP) do for his clients? This graphic provides a great visual answer.

Personal Financial Statement – Excel Template – Free Download

Personal Financial Statement

Key Tax and Financial Data for 2016 Fact Sheet – Free Download

Successful Portfolios is pleased to offer our Key Tax Financial Data for 2016 Fact Sheet, available here as a free download pdf. This handy fact sheet includes tax tables and retirement account contribution limits. Be sure to check back for updates as they become available. Call Successful Portfolios at (727) 744-3614 to discuss this and other tax-advantaged investment strategies. […]

A low risk way to earn a return on the cash balance in your brokerage account

Buying a stock and selling a corresponding single stock futures contract (SSF) can be a a low risk way to earn a return on the cash balance in your brokerage account. To learn how, download Successful Portfolios handy EFP Return Calculator and give us a call at (727)744-3614.