How to Hedge Your Portfolio with a Protective Put Option

You may have a strong hunch that the stock market is ready to drop. A protective put option can is a sensible strategy when a market decline appears imminent yet uncertain. Watch the brief video to learn more.

Twenty-Two Tax-Saving Tips and Tricks for Investors

A must-read financial planning checklist of twenty-two tax-saving tips and tricks for investors seeking tax alpha.

Five Ways Protect Your Wealth in a Stock Market Crash

Learn more about protecting wealth with 1) Asset Allocation, 2) Market Timing, 3) Stop-loss Orders, 4) Structured Products including annuities, 5) Put options.

Online Broker Commission and Margin Rates Comparison Grid

Check out this Cost Comparison of Commission and Margin Rates at Interactive Brokers (IB), E*Trade, Fidelity, Scottrade, Schwab, TD Ameritrade and Vanguard. Talk to Successful Portfolios’ team of expert Certified Financial Planners and Chartered Financial Analysts. We’ll help you choose the best online broker to suit your investment management objectives.

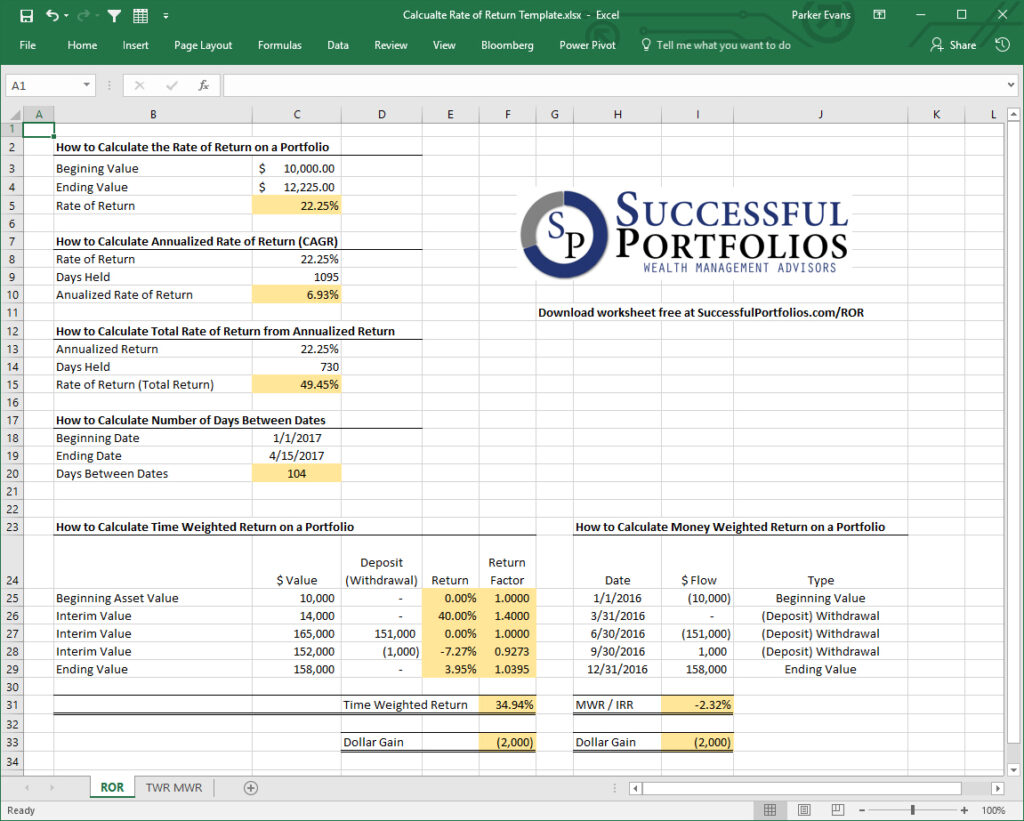

Learn How to Calculate the Rate of Return on Your Investment Portfolio or Any Other Asset: Free Excel Worksheet.

Learn how to use Excel to calculate: (1) Total Rate of Return (ROR) on an asset or portfolio; (2) Annualized Return (AR), Annualized Percentage Rate (APR), or Compound Annual Growth Rate (CAGR); (3) Total ROR from CAGR, APY or AR; (4) Number of days between dates; (5) Time Weighted Return (TWR); (6) Money Weighted Return (MWR) or Internal Rate of Return ((IRR).

Stock Picking, Short Selling and Put Options

Stock Picking, Short Selling and Put Options with Successful Portfolios Stock picking is not easy. Sure you can make money picking stocks. But the real question is can you do better than simply buying a low cost index ETF? Most investors can’t. Buying a put option is an alternative to short-selling. Picking stocks to short-sell is […]

Bottom Fishing Stock Market Turnaround Situations

…What once may have been a respected, widely-held large cap stock is now a despised and embarrassing penny stock subject to exchange delisting. Many times these companies go bankrupt and stockholders lose everything. Other times a turnaround develops that offers favorable short-term trading opportunities. Some turnaround situations even prove to be long-term stock market winners going forward. It is important to recognize that a stock can represent a good investment risk even if it’s highly likely to decline in price and eventually become worthless. Let me explain…

Selling Cash Secured Puts Using Our Free Excel Worksheet

Selling a cash secured put can be an effective yield enhancement strategy for cash waiting to be invested…

Ten Wall Street Investing Myths Revealed

1. “You cannot invest directly in an index…” 2. Bonds are safer than stocks…. 3. Options are riskier than stock… 4. Smart money invests in Hedge Funds and Private Equity… 5. Buy and Hold is dead… & Five more myths debunked…