Asset Allocation, Risk Tolerance, and Technical Analysis

Conventional asset allocation calls for investors to strategically sell stocks as they rise and buy stocks as they fall…. Trouble is many investors cannot follow the core precept of conventional asset allocation.

A Low-Cost Global Growth & Income ETF Portfolio

At Successful Portfolios, we recently created a low-cost Global Growth & Income Model Portfolio. A breakdown of the portfolio can be found here. Our model holds five strategically selected Exchange Traded Funds (ETFs). Each ETF is available for commission-free trading through Schwab ETF OneSource. Our selected ETFs are as follows:

What are S&P Bond Ratings?

Standard and Poor’s (S&P) rates the creditworthiness of thousands of corporate and governmental bond issuers as does Moody’s and Fitch. Credit ratings, ratings outlooks and ratings changes are a huge influence on bond prices. It is important to recognize that credit ratings represent only the opinion of the issuing rating agency and that those opinions can sometimes prove to be wrong……

Good, Clean Fun with Numbers: Benford’s Law

One cannot have too many numbers, really. Imagine you have a data set that includes many numbers, like U.S. city populations, or the odometer readings for all the cars in an area. Look at only the first digit of each number in your set of populations or mileage, and count each time 1 through 9 occurred. Each number should occur about the same number of times. You would have about the same number of 1’s as you would of 2’s or 3’s, right? The correct answer is somewhat more fun.

What’s to like about Closed End Funds (CEFs)?

Unlike ETFs, Closed End Funds generally have no preset process or mechanism for creation and redemption of shares. Instead, when an investor wants to buy or sell he must do so in the open market. As a result CEFs often trade at a discount to net asset value. A substantial discount can represent a favorable opportunity to invest.

What is the “Fear Index” and why should I care?

The VIX Index is a measure of market expectations for near-term stock price volatility derived from current market quotes on S&P 500 index options. The VIX is also known as the “Fear Index”. Watching the VIX allows professional portfolio managers to monitor the cost of principal-protecting a stock portfolio. As you can see in the chart […]

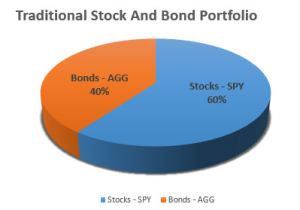

Asset Allocation Should be as Simple as Possible but No Simpler

A very simple, yet highly useful asset classification system consists of just two asset classes: (1) equity-growth-stocks and (2) debt-income-bonds.

The Low Risk Anomaly

Modern Portfolio Theory (MPT) is a statistical formulation of the risk reduction benefits of diversification. Under Modern Portfolio Theory, risk is measured quantitatively as volatility or beta. Volatility is the variance or standard deviation of an asset’s returns. Beta is the sensitivity of an asset’s returns to the return of the overall market. High-beta and […]

Investment Research

Ongoing research and due diligence is an integral part of Successful Portfolios’ investment decision-making process.