Interest rate risk is fundamental to fixed income investments including U.S. Treasury bills, notes and bonds.

By way of example, as of this writing the benchmark ten year Treasury note yields 2.25% to maturity. If you invest today at 2.25% with the intention of holding to maturity, your interest rate is guaranteed. Your risk is limited to the opportunity cost associated with the timing of your investment. Perhaps if you wait a short time to invest, you can purchase your Treasury note with a 3.00% yield to maturity.

That would be good. But consider the flip-side. If you wait and the market yield on the Treasury note falls by .75%, then you can lock in only a 1.50% yield to maturity. Not good. These three scenarios represent interest rate risk in its most basic form.

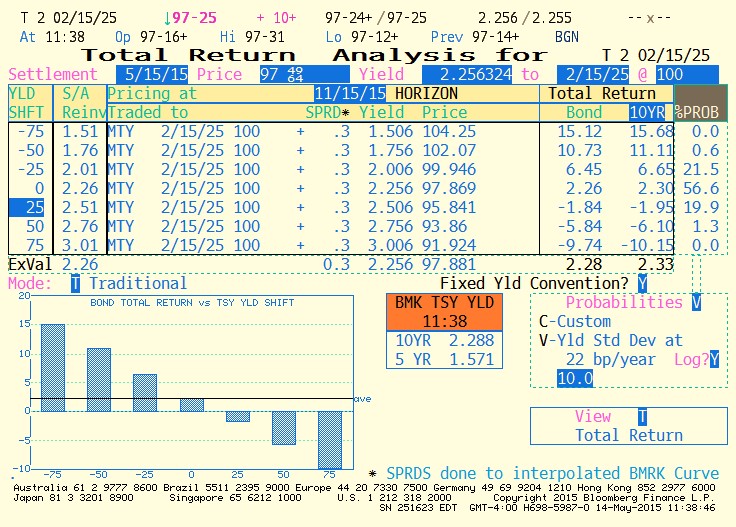

Next let’s look at your return if you invest today and sell in six months. The Bloomberg Total Return Analysis shown below tells the story.

We can see from the graphic that if the yield on your Treasury note stays at 2.26%, the price will be unchanged and your total return is 2.26% annualized. If the yield to maturity moves up to 3.01% your total return (includes interest and price decline) is -9.74% annualized. If the yield moves down to 1.51%, your total return is + 15.12% annualized. In the far column you see that market based % probability is “0.0” meaning that annualized total returns of +15.12% or -9.74% are very unlikely.

More likely the yield to maturity in six months will range between 2.01% and 2.51% producing an annualized total return somewhere between -1.84% and +6.45% respectively. Keep in mind these are annualized total returns for a six month period. So if the bond yield rises to 2.76% and you sell in six months, your realized total return will be -2.92% (one half of -5.84%, the annualized total return).

Find out how much interest rate risk you are taking. Call SuccessfulPortfolios today at (727) 744-3614. Successful Portfolios LLC is an independent SEC Registered Investment Advisor located in Clearwater, FL.[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

Get an expertly tailored investment portfolio custom to your needs. Book a free consult to secure retirement income, reduce taxes, and safely grow wealth.

Get an expertly tailored investment portfolio custom to your needs. Book a free consult to secure retirement income, reduce taxes, and safely grow wealth.

Copyright© 2025 Successful Portfolios. Powered by PressGo Digital