Selling a covered call is a powerful yet simple technique that enables you to increase the cash flow from your stock. Call options are available for trading on thousands of different stocks.

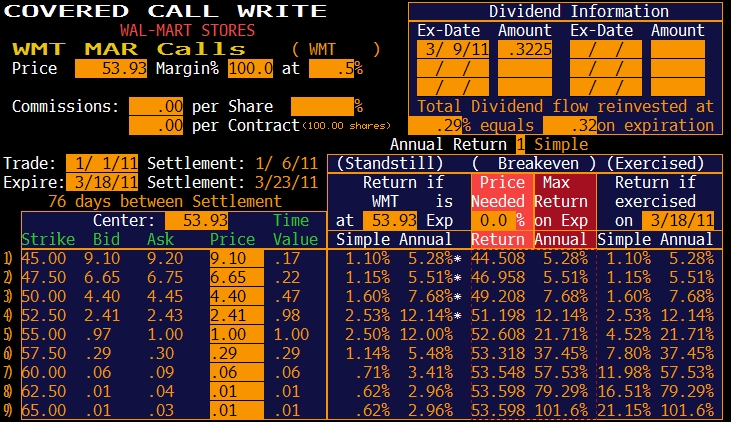

Using the Bloomberg Professional Service we can easily model the resulting cash flow return on our example. In line five below we see the annualized cash flow return is 12% – even if the price of WMT standstill or declines!

A detailed explanation of this analysis is beyond the scope of this post. To learn more about options, I recommend the Options Industry Council’s extensive free educational materials especially the Investor’s Guide booklet. For a personal consultation on how to use options to achieve your investment goals please call Successful Portfolios at (727) 744-3614 or click the help button at the top right of this page.

A detailed explanation of this analysis is beyond the scope of this post. To learn more about options, I recommend the Options Industry Council’s extensive free educational materials especially the Investor’s Guide booklet. For a personal consultation on how to use options to achieve your investment goals please call Successful Portfolios at (727) 744-3614 or click the help button at the top right of this page.

Get an expertly tailored investment portfolio custom to your needs. Book a free consult to secure retirement income, reduce taxes, and safely grow wealth.

Get an expertly tailored investment portfolio custom to your needs. Book a free consult to secure retirement income, reduce taxes, and safely grow wealth.

Copyright© 2024 Successful Portfolios. Powered by PressGo Digital