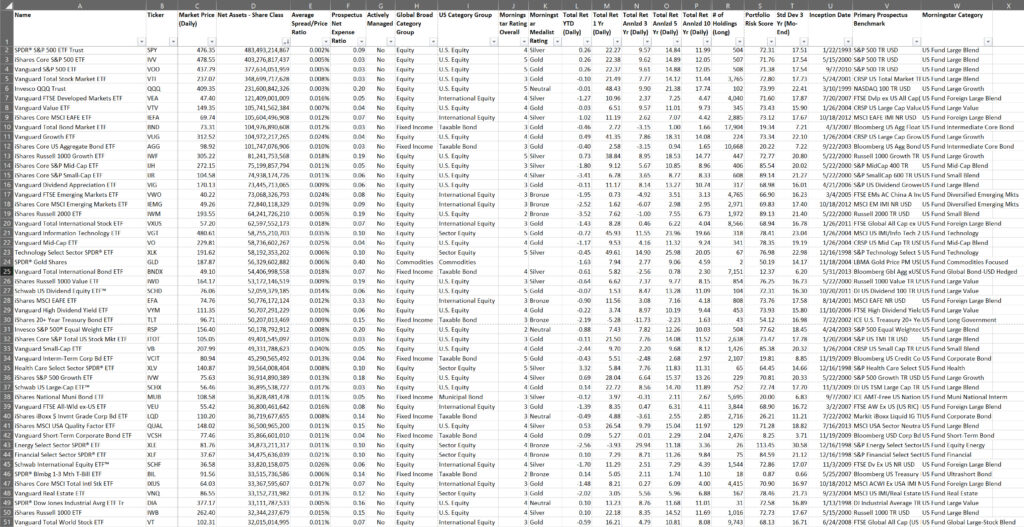

ETF Worksheet For 2024

If you’re looking for a smart way to invest your money, exchange-traded funds (ETFs) might be your best bet. These investment vehicles offer a hassle-free and cost-effective way to access a diverse range of assets, including stocks, bonds, and alternative investments.

The Overlooked Tax Benefits of Non-Qualified Brokerage Accounts

Many investors focus solely on tax-advantaged retirement accounts like 401(k)s and IRAs when building their portfolios. However, non-qualified brokerage accounts can also provide significant tax benefits that are often overlooked. In this post, we’ll explore some of the key tax advantages of using a taxable brokerage account as part of your overall investment strategy.

Navigating Investment Risk

Effective risk management is crucial for long-term portfolio success. This article outlines the top 20 investment risks that any serious money manager should know and understand, with examples and strategies for controlling and mitigating risk.

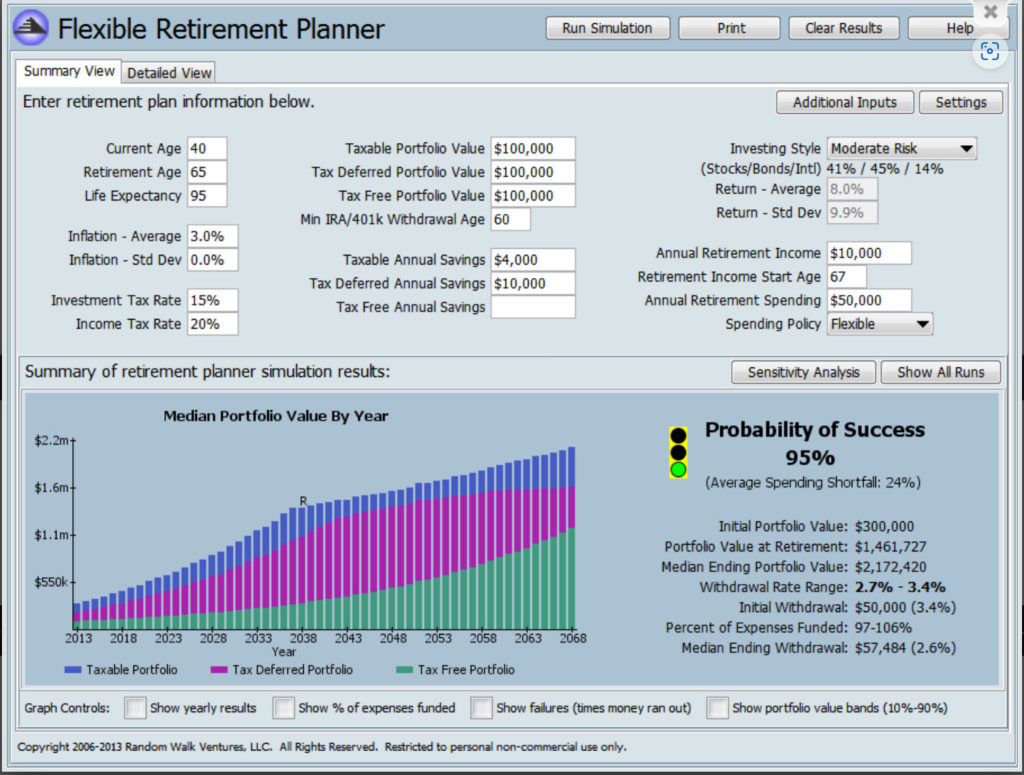

Monte Carlo Retirement Calculators: Navigating the Future with the Flexible Retirement Planner

Monte Carlo Retirement Calculators: Navigating the Future with the Flexible Retirement Planner Retirement planning, in its essence, is a voyage through time. As you glance at the visual showcasing The Flexible Retirement Planner interface—with its promising ‘95% chance of success’—you’ll get a glimpse of how modern tools can simplify this voyage. Throughout this article, we’ll […]

Your Guide to Individual Investment Policy Statements (IPS)

Investment Policy Statements (IPS) have long been considered a key component of managing institutional portfolios. However, individual investors often overlook the importance of establishing a comprehensive IPS to guide their personal investment decisions. Recognizing this gap, the CFA Institute’s “Elements of an Investment Policy Statement for Individual Investors” is a valuable resource for those looking to create a structured and disciplined approach to managing their investments.

How to Trade Momentum and Volatility in the Stock Market

Hello, fellow investors and aspiring traders! Today we will explain how stock price momentum and volatility are related and why you should care about them. You’ve probably heard the adage, “What goes up must come down,” right? Well, it turns out that this applies to stocks as well. Let me show you how.

Core-Satellite Investment Strategy

When it comes to achieving your financial goals, diversifying your portfolio, reducing costs and taxes, and potentially outperforming the market, the core-satellite investment strategy is worth considering. This strategy combines passive and active investing techniques, including thematic investing and stock picking, to optimize your portfolio’s performance. However, the value of collaborating with a well-qualified fiduciary advisor cannot be overstated. While DIY investing can be tempting, working with an experienced professional provides invaluable guidance and support.

A Systematic Approach to Trend Following: Pacer Trend Pilot ETFs

Trend following is a popular trading strategy that seeks to capitalize on market movements in a specific direction over time. Instead of attempting to predict future price levels, trend followers adjust their positions according to the current trend. The Pacer Trend Pilot ETFs offer a systematic approach to trend following using a rules-based methodology to switch between equity and treasury exposure based on the trend’s strength. This approach seeks to reduce risk by selling stocks when the market declines.

Mastering the Art of Position Sizing: The Key to Unlocking Portfolio Diversification and Risk Management

Position sizing is a critical concept in portfolio management and diversification. It refers to the process of determining the appropriate amount of capital to allocate to a specific investment or asset within a portfolio. Position sizing is essential for managing risk, optimizing returns, and achieving a well-balanced investment portfolio that reflects an investor’s risk tolerance, objectives, and time horizon.

Why Invest in Gold without a Bullion or Coin Dealer?

Investing in gold has long been considered a safe haven and a hedge against inflation. However, when it comes to purchasing gold, investors face the choice between buying physical gold from coin or bullion dealers and investing in gold ETFs through a Registered Investment Advisor (RIA) like Successful Portfolios. In this blog post, we’ll explore the benefits of choosing a gold ETF with the help of Successful Portfolios over physical gold and why it may be the more intelligent choice for your investment portfolio.