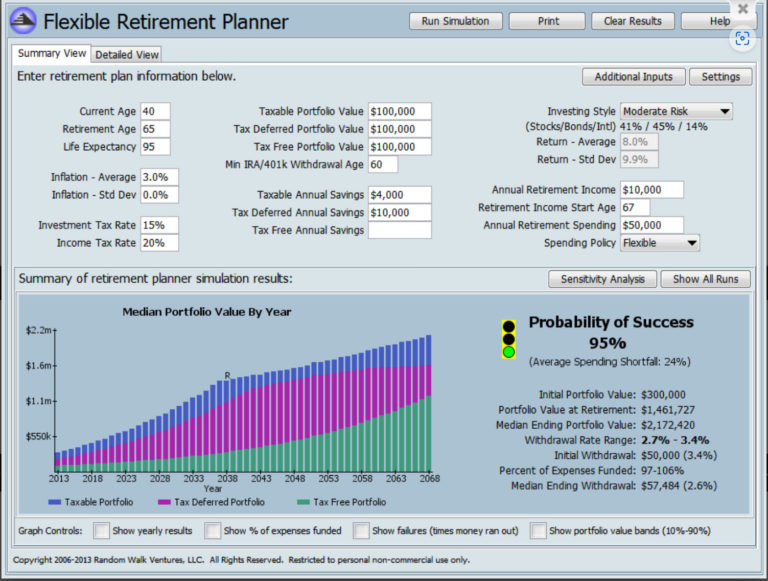

Retirement planning, in its essence, is a voyage through time. As you glance at the visual showcasing The Flexible Retirement Planner interface—with its promising ‘95% chance of success’—you’ll get a glimpse of how modern tools can simplify this voyage. Throughout this article, we’ll delve deeper into the intricacies of such simulations and strategies, helping you navigate the seas of financial markets with confidence.

Monte Carlo methodology makes for unique and powerful retiement calculator. . Instead of predicting the future based on a singular set of assumptions, it runs the numbers through thousands of scenarios, varying market returns, inflation rates, and other vital parameters. This comprehensive approach becomes especially crucial in accounting for unpredictability and randomness. Notably, this method helps identify risks like the sequence of returns risk—a significant pitfall where negative returns early in your retirement can derail an otherwise robust plan.

In 2024, the dynamics of retirement planning have reached a critical juncture. With stock markets soaring and risk-free interest rates surging over 5% for the first time in decades, the bond market’s horizon seems brighter. However, shadows like the specter of inflation still lurk in this promising landscape.

Your retirement journey today is more than just a game of hope; it’s about leveraging these dynamics, recognizing potential pitfalls, and plotting the most secure course forward.

Amidst the complex landscape of retirement planning, one fundamental question persists: How much can I withdraw from my retirement savings annually without running out of money? Understanding sustainable withdrawal rates and subjecting your retirement strategy to rigorous stress testing is the answer. The output of a retirement calculator is only as good as its inputs.

Historically, the “4% Rule” has served as a widely accepted guideline. This rule suggests that if you withdraw 4% of your retirement savings in the first year and then adjust that amount for inflation in subsequent years, there’s a high likelihood your savings will last for 30 years. But with the evolving dynamics of financial markets, continuous assessment, and adjustments are necessary. Tools like the Flexible Retirement Planner, equipped with Monte Carlo simulations, play an instrumental role in refining these rates.

The Flexible Retirement Planner is more than just a tool; it’s a compass.

Efficiency Meets Depth: Set up and run in-depth retirement simulations within minutes.

Exploratory Scenarios: Evaluate varying circumstances, from early retirement decisions to unforeseen financial events, to see their impact on your retirement landscape.

Granular Customization: Refine parameters annually, ensuring your plan aligns closely with real-world scenarios.

Focused Insights: Identify the primary influences on your retirement journey, from market shifts to personal spending.

Expertise is paramount to harness the potential of tools like the Flexible Retirement Planner. Successful Portfolios, an SEC Registered Investment Advisor, boasts a track record of guiding hundreds of retirees and soon-to-be retirees using these advanced simulations. Their understanding of the intricate interplay of numbers, assumptions, and predictions is invaluable in today’s volatile financial climate.

Today’s retirement journey isn’t just a passive sail into the sunset. Its active navigation of the complex financial waters is even more intricate with stock market highs, changing interest rates, and the looming cloud of inflation. But with Monte Carlo simulations, the Flexible Retirement Planner, and the expert guidance of the pros at Successful Portfolios, you’re not just preparing for the future but set up to master it. Ready to chart your course? Let’s navigate your financial future together.

Get an expertly tailored investment portfolio custom to your needs. Book a free consult to secure retirement income, reduce taxes, and safely grow wealth.

Get an expertly tailored investment portfolio custom to your needs. Book a free consult to secure retirement income, reduce taxes, and safely grow wealth.

Copyright© 2025 Successful Portfolios. Powered by PressGo Digital