Warren Buffett’s “Know-Nothing” Portfolios: A Critical Perspective

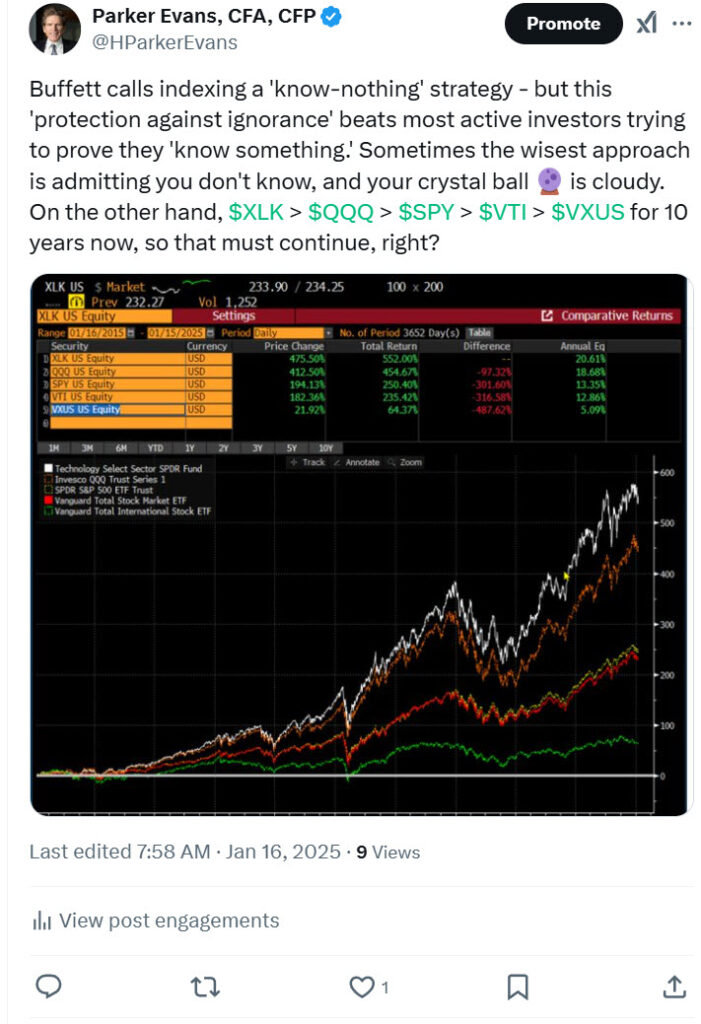

Buffett calls indexing a ‘know-nothing’ strategy – but this ‘protection against ignorance’ beats most active investors trying to prove they ‘know something.’ Sometimes, the wisest approach is admitting you don’t know, and your crystal ball 🔮 is cloudy. On the other hand, $XLK > $QQQ > $SPY > $VTI > $VXUS for 10 years now. Can that continue?

Understanding Investment Risk: The Key to Building Successful Portfolios

Imagine two investors: one cautiously watching their steady but insufficient gains, the other riding a rollercoaster of higher highs and lows. What’s the difference? Their understanding of investment risk. As a financial advisor with years of experience counseling investors, I’ve seen firsthand how grasping this concept can make or break portfolios and retirement nest eggs. Today, let’s demystify investment risk and explore why it’s crucial for achieving your financial goals.

Bitcoin versus Gold

Two of the most popular alternative assets are gold and Bitcoin. While both are often touted as hedges against inflation and potential stores of value, they have distinct characteristics that set them apart. In this blog post, we will explore the key differences between gold and Bitcoin.

Twitter X

See a sample of Successful Portfolios recent tweets or posts on Twitter X.

The Purpose of Diversification

Imagine a fisherman setting out to sea, dreaming of catching the biggest fish of his life. He seeks a spectacular marlin and focuses all his resources and effort on catching it. It’s an exciting prospect, but it’s also incredibly risky. It brings to mind Hemingway’s The Old Man and the Sea. What if Santiagos’ marlin gets away? What if his boat sinks? Or what if he runs short of drinking water on his journey? Or what if his fish is nowhere to be found? This allegory captures the essence of investment diversification. You may have heard the age-old advice: “Cast a wide net.”…

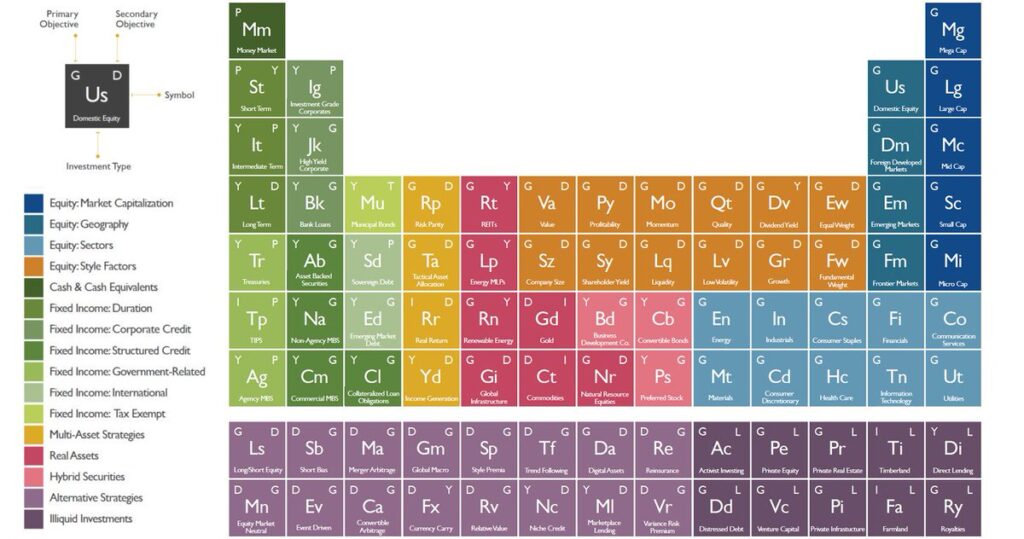

What is your Investment Philosophy?

At Successful Portfolios, our primary goal is to help clients achieve their financial objectives while managing risk. Our trained professionals carefully assess each client’s risk tolerance and time horizon before constructing customized portfolios. We integrate prudent risk management across various investment philosophies when selecting appropriate assets for each client.

Partner with a Fiduciary Advisor

More and more people are realizing the value of working with a registered investment advisor (RIA) firm for their financial planning and investment management needs. It’s important to know that an RIA is legally obligated as a fiduciary to put client interests first. This differs from a brokerage firm that may promote products with higher fees or lower quality to earn commissions.

Satisfaction Guarantee

At Successful Portfolios, we aim to make your experience exceptional from day one. As a new client, you’re covered by our Satisfaction Guarantee. Here’s how it works:

Successful Portfolios Earns Five Star Rating

Successful Portfolios has earned the highest possible rating from investor.com, a trusted source of unbiased and transparent information on financial advisors. Each month, investor.com analyzes the latest regulatory data from the SEC IAPD database of over 17,000 US-based RIAs.

The Ultimate Wealth Management Solution: Why You Should Hire an Independent CFA and CFP Professional

The Ultimate Wealth Management Solution: Why You Should Hire an Independent CFA and CFP Professional Introduction In today’s fast-paced world, managing your wealth and making sound financial decisions has become more important than ever. So Hiring a CFA and CFP professional now. With an overwhelming number of financial advisors and investment options available, it’s crucial […]