At Successful Portfolios LLC, we’re always looking for tools to help our clients make informed financial decisions. Today, I want to highlight two excellent, free Excel-based income tax planning and modeling resources that we have used for many years: Geoff Mendal’s Income Tax Planning Excel Sheet and Glenn Reeves’ Excel 1040 Worksheet.

Geoff Mendal, the former Google engineer, has created a quick, accurate, lightweight Excel tool for income tax planning. This sheet is particularly useful for:

What sets Mendal’s tool apart is its blend of simple sophistication and speed. It incorporates complex tax rules while remaining accessible to both financial professionals and savvy individual investors.

You can download Mendal’s Income Tax Planning Excel Sheet from his website: http://www.taxvisor.com/taxes/index.html

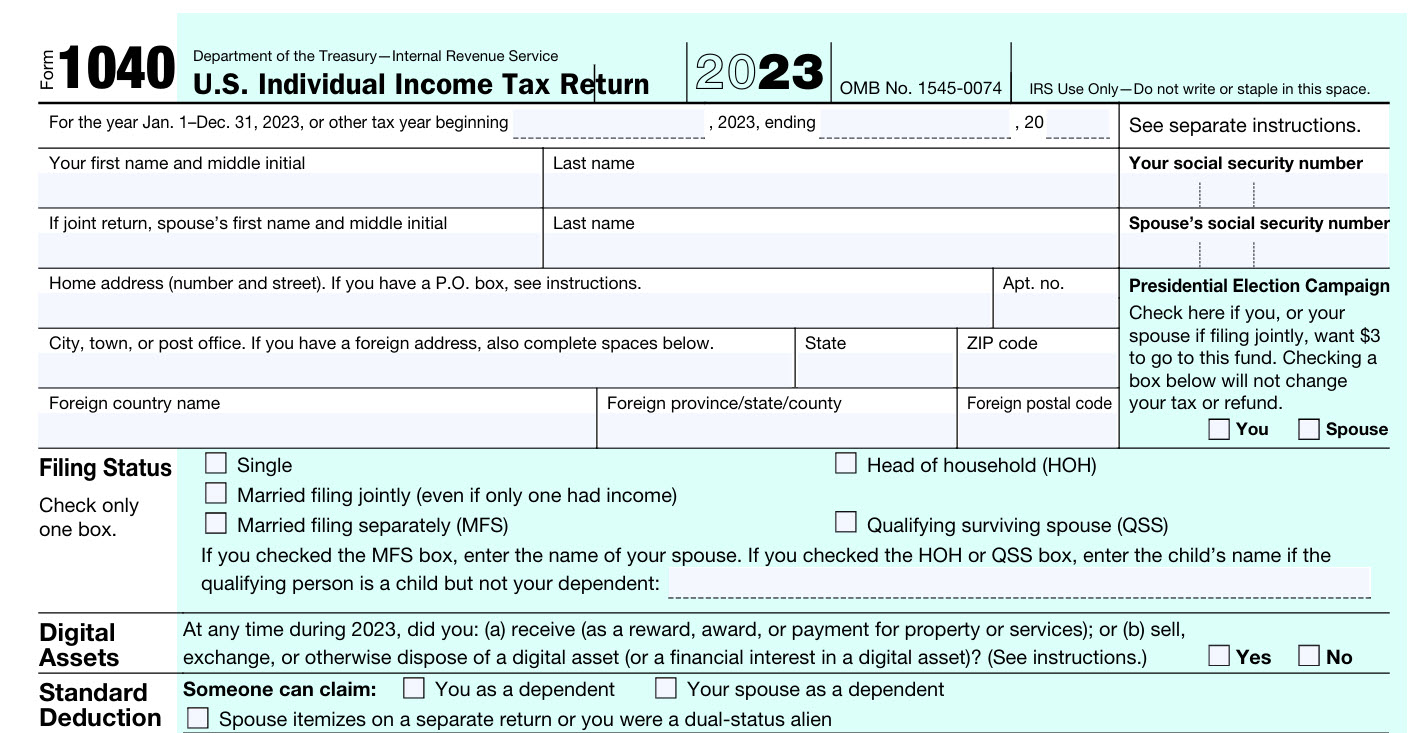

Glenn Reeves has been providing his Excel 1040 Worksheet for free since 1997, and it has become a go-to resource for many tax professionals and individual filers. This tool:

Reeves’ worksheet is known for its accuracy and speed, making it an invaluable resource for quick tax calculations and what-if scenarios.

You can download Glenn Reeves’ Excel 1040 Worksheet from his website: https://sites.google.com/view/incometaxspreadsheet/home/download

In our practice at Successful Portfolios LLC, we find these Excel-based tools invaluable for several reasons:

These Excel tools not only save time but also provide valuable insights for tax planning. They allow users to run multiple scenarios quickly, helping to optimize tax strategies. For instance, you can easily compare the tax implications of taking a lump sum distribution versus spreading it over several years. This hands-on approach empowers clients to better understand their tax situation and make more informed financial decisions. As advisors, we find these tools invaluable for illustrating complex tax concepts in a tangible way to our clients

While these Excel tools are powerful, they’re most effective in a comprehensive financial planning strategy. At Successful Portfolios LLC, we use them to:

It’s important to note that while these sophisticated tools cannot always replace professional tax advice from a CPA or EA, you should always consult with a qualified tax professional for your specific situation.

Geoff Mendal’s Income Tax Planning Excel Sheet and Glenn Reeves’ Excel 1040 Worksheet show how freely available tools can significantly enhance financial planning and tax analysis. We encourage our clients and fellow financial professionals to explore these resources.

Remember, effective tax planning is ongoing, not a once-a-year event. By leveraging these powerful Excel tools, we can make more informed decisions year-round, potentially leading to better financial outcomes for our clients.

Have you used these or similar Excel tools in your financial planning? We’d love to hear about your experiences and any tips you might have. Feel free to contact us at Successful Portfolios LLC to discuss how we can help you optimize your tax planning strategy.

Get an expertly tailored investment portfolio custom to your needs. Book a free consult to secure retirement income, reduce taxes, and safely grow wealth.

Get an expertly tailored investment portfolio custom to your needs. Book a free consult to secure retirement income, reduce taxes, and safely grow wealth.

Copyright© 2025 Successful Portfolios. Powered by PressGo Digital