Read this page before you claim your Social Security benefits. Don’t make an uninformed fast grab for cash.

According to a recent report issued by the Consumer Financial Protection Bureau (CFPB), “Annually more than 2 million consumers make one of the most important financial decisions of their lives: choosing when to begin collecting Social Security retirement benefits.

Yet, many make the decision based on limited or incorrect information. As a result, many consumers start collecting benefits at the earliest possible claiming age without understanding that by claiming early, they receive a reduction in benefits that can threaten their financial security in retirement.”

The financial planning professionals at Successful Portfolios strongly recommend that you download the CFPB report and test drive the CFPB website’s Interactive Social Security tool shown below.

[fusion_builder_container hundred_percent=”yes” overflow=”visible”][fusion_builder_row][fusion_builder_column type=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none”]

The the risk-adjusted return from delaying your Social Security claim could exceed that of any other investment you can make. Call Successful Portfolios at (727) 744-4818 and talk with a Certified Financial Planner professional today. We can help you evaluate your investment portfolio and retirement nest egg in the context of your monthly Social Security benefit. Remember the purpose of Social Security is to ensure you never run out of income during your lifetime. By waiting to until you are 70 years old to apply for Social Security you could increase your total lifetime dollar benefit by more than $100,000. Shown below is a relevant screenshot snippet of our free download Social Security Benefit Analysis worksheet.

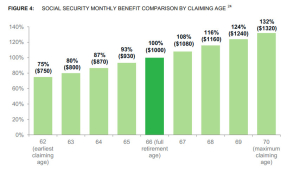

The concept is similar for other ages and benefit amounts. The chart below shows how much you can increase your monthly benefit payment by simply delaying your claim. This chart assumes you were born between 1943 and 1954 and you have an expected monthly befit of $1,000 at age 66.

[/fusion_builder_column][fusion_builder_column type=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none”]

The maximum Social Security benefit for an individual retiring at age 66, the full retirement age in 2015, is $2,663 per month. If in 2015 you retire early at age 62, the maximum benefit is $2,025. If you retire later at age 70 it is $3,501. By the way, if you have recently started collecting your monthly benefits within the past 12 months, you can still change your mind, pay back what you received and collect a higher monthly benefit later. We recommend that you not buy any annuity contract until you have carefully evaluated your Social Security retirement options.

At Successful Portfolios we readily admit we don’t much like annuities offered by insurance companies. Social Security, on the other hand, is in essence the ultimate life annuity with a high internal rate of return, a U.S. Government Guaranty, and drum roll please, it’s indexed for inflation! No annuity offered by an insurance company comes close to matching these attributes. It could very well be that your Social Security is the only annuity you’ll ever need. And by the way, if you recently bought an insurance company annuity it’s possible you can get a full refund of your annuity premium without penalty.

For a comfortable and prosperous retirement you should save money and create a durable retirement nest egg in addition to your Social Security. For a free retirement planning consultation, call the professionals at Successful Portfolios today.

Read our related post How to Calculate the Internal Rate of Return on an Annuity or Pension.

[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

Get an expertly tailored investment portfolio custom to your needs. Book a free consult to secure retirement income, reduce taxes, and safely grow wealth.

Get an expertly tailored investment portfolio custom to your needs. Book a free consult to secure retirement income, reduce taxes, and safely grow wealth.

Copyright© 2025 Successful Portfolios. Powered by PressGo Digital