Core-Satellite Investment Strategy

When it comes to achieving your financial goals, diversifying your portfolio, reducing costs and taxes, and potentially outperforming the market, the core-satellite investment strategy is worth considering. This strategy combines passive and active investing techniques, including thematic investing and stock picking, to optimize your portfolio’s performance. However, the value of collaborating with a well-qualified fiduciary advisor cannot be overstated. While DIY investing can be tempting, working with an experienced professional provides invaluable guidance and support.

Mastering the Art of Position Sizing: The Key to Unlocking Portfolio Diversification and Risk Management

Position sizing is a critical concept in portfolio management and diversification. It refers to the process of determining the appropriate amount of capital to allocate to a specific investment or asset within a portfolio. Position sizing is essential for managing risk, optimizing returns, and achieving a well-balanced investment portfolio that reflects an investor’s risk tolerance, objectives, and time horizon.

Buy, Sell, or Hold?

Whether you hold investments or uninvested cash, you need to know when to buy, sell, or do nothing. It’s an unavoidable high-stakes decision…

Five Ways Protect Your Wealth in a Stock Market Crash

Learn more about protecting wealth with 1) Asset Allocation, 2) Market Timing, 3) Stop-loss Orders, 4) Structured Products including annuities, 5) Put options.

Asset Allocation, Risk Tolerance, and Technical Analysis

Conventional asset allocation calls for investors to strategically sell stocks as they rise and buy stocks as they fall…. Trouble is many investors cannot follow the core precept of conventional asset allocation.

Learn about the Successful Portfolios Client Report

Learn about the Successful Portfolios Client Report, an information rich, yet concise portfolio report designed to help you understand how we invest your money.

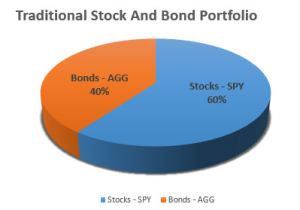

Asset Allocation Should be as Simple as Possible but No Simpler

A very simple, yet highly useful asset classification system consists of just two asset classes: (1) equity-growth-stocks and (2) debt-income-bonds.