Mastering the Art of Position Sizing: The Key to Unlocking Portfolio Diversification and Risk Management

Introduction:

Position sizing is critical in portfolio management, diversification, and risk management. Position sizing refers to the process of determining the appropriate amount of capital to allocate to a specific investment or asset within a portfolio. Thoughtful position sizing is essential for managing risk, optimizing returns, and achieving a well-balanced investment portfolio that reflects an investor’s risk tolerance, objectives, and time horizon.

In the context of portfolio management, position sizing contributes in the following ways:

Risk management:

By allocating different percentages of a portfolio to different assets, position sizing can help mitigate the impact of a poor-performing investment on the overall portfolio. This approach allows investors to control the maximum potential loss for a single position or asset class.

Diversification:

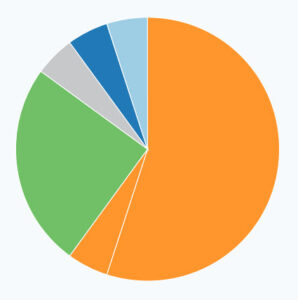

Position sizing promotes portfolio diversification by spreading investments across various asset classes, industries, and geographic regions. This reduces the overall portfolio risk by ensuring that the performance of one asset or sector does not disproportionately influence the entire portfolio.

Risk tolerance:

It allows investors to align their portfolios with their risk tolerance. Aggressive investors may opt for a larger allocation and focus on high-risk, high-reward investments, while conservative investors may prefer smaller position sizes and lower-risk assets in general.

Asset allocation:

It is helps investors maintain their desired asset allocation, which is the strategic distribution of investments across various asset classes. By regularly reviewing and adjusting position sizes, investors can ensure their portfolio remains aligned with their long-term objectives and risk tolerance.

Portfolio rebalancing:

Position sizing plays a crucial role in portfolio rebalancing, which is the process of adjusting asset allocations to maintain the desired level of risk and return. As market conditions change and asset values fluctuate, investors should review their position sizes and rebalance their portfolios to maintain diversification and risk management objectives.

Position size rules, cognitive biases, and behavioral finance:

Cognitive biases and emotions can influence investors’ decision-making, which may lead to suboptimal position sizing. Some common biases that affect position sizing include overconfidence, anchoring, loss aversion, and herd mentality. To mitigate the impact of cognitive biases, investors can employ systematic position size rules, such as a fixed percentage of the portfolio, or risk-based approaches like the Kelly criterion or the risk parity method.

Portfolio leverage, margin, and position sizing:

Portfolio leverage, which involves borrowing funds or using financial instruments to increase exposure to investments, is closely related to position sizing. For example, investors can effectively increase their position size using borrowed money in a margin account without depositing additional capital. However, this increased exposure amplifies both potential gains and losses, making it essential for investors to carefully manage their position sizes and maintain a well-diversified portfolio that aligns with their risk tolerance.

Conclusion:

Position sizing is a vital component of portfolio management and diversification. By understanding its relationship with asset allocation, leverage, and other risk management factors, investors can make informed decisions to optimize returns and maintain a well-balanced investment portfolio that aligns with their risk tolerance, objectives, and investment horizon.

Make an Appointment

Talk to Parker Evans, CFA, CFP

Book Now