Trend following is a popular trading strategy that seeks to capitalize on market movements in a specific direction over time. Instead of attempting to predict future price levels, trend followers adjust their positions according to the current trend. The Pacer Trend Pilot ETFs offer a systematic approach to trend following using a rules-based methodology to switch between equity and treasury exposure based on the trend’s strength. This approach seeks to reduce risk by selling stocks when the market declines.

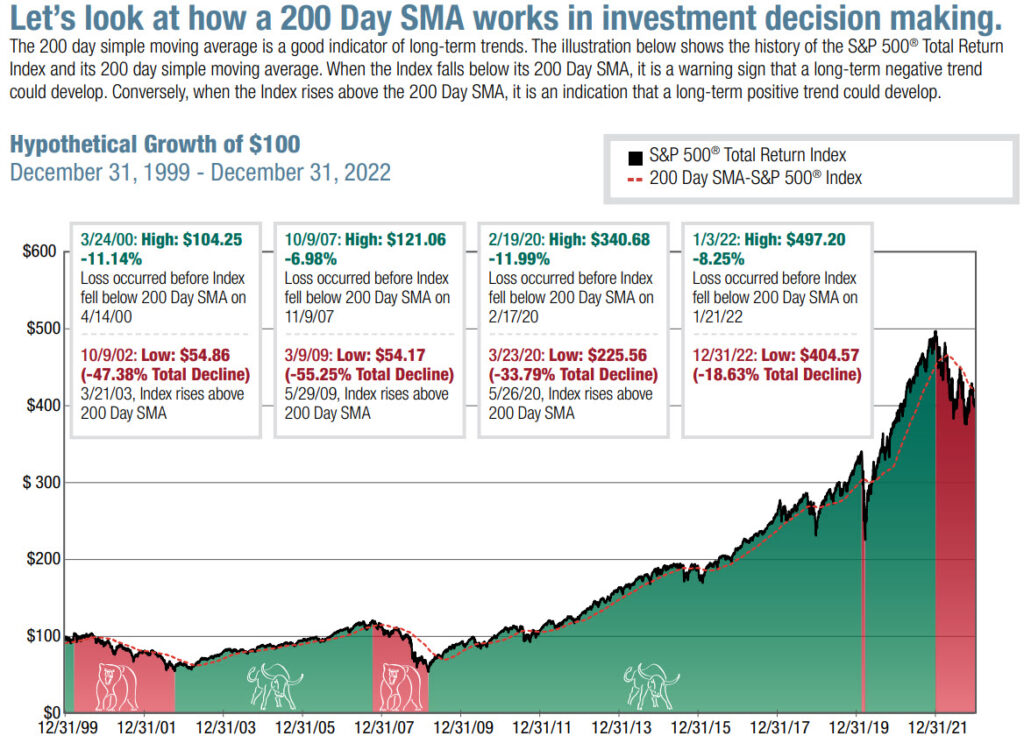

One way that trend following controls risk is by employing moving average crossover systems, which act as a form of stop-loss. By selling stocks when the market declines, trend followers can limit their losses and potentially benefit from a subsequent shift into safer assets, such as Treasury bills. The Pacer Trend Pilot ETFs’ methodology, which alternates between equity and treasury exposure based on the trend’s strength, exemplifies this risk control mechanism.

However, the risk reduction provided by trend-following strategies comes at the expense of whipsaw risk. Whipsaws occur when prices repeatedly cross the moving averages, generating conflicting signals and potentially causing losses in sideways or choppy markets. This risk is inherent in moving average crossover systems, as they are reactive and respond to price changes after they occur, which can result in late entries and exits.

Despite whipsaw risk, the Pacer Trend Pilot ETFs have built-in risk control features to help mitigate this issue. Their methodology consists of three modes:

The Pacer Trend Pilot ETFs use these three modes to capture gains in rising markets while minimizing losses in declining markets, balancing risk and reward. Although whipsaw risk remains a concern, the ETFs’ rules-based methodology and systematic approach to trend following help to manage this risk.

One significant advantage of trend-following strategies, including the Pacer Trend Pilot ETFs, is once out of the market, they are designed to re-enter the market when the market trend turns up. This ensures that investors participate in the market’s gains if the uptrend continues, which is crucial for achieving long-term financial goals. When a trend follower exits the market due to a temporary downturn, they monitor the market for signals that the uptrend has resumed. Once the trend re-establishes itself, the trend follower re-enters the market to capture potential ongoing gains, thus mitigating the risk of missing out on a significant long-term uptrend.

Another advantage of using the Pacer Trend Pilot ETFs in a trend-following system is their tax efficiency. Due to their unique creation and redemption process, ETFs offer a more tax-efficient structure than traditional mutual funds. This process allows ETFs to minimize or even eliminate capital gains distributions, which can be especially beneficial in a trend-following strategy that potentially involves frequent buying and selling of underlying assets.

In conclusion, the Pacer Trend Pilot ETFs offer a systematic and tax-efficient approach to trend following, balancing risk control with the inherent whipsaw risk associated with moving average crossover systems. Their rules-based methodology, which alternates between equity and treasury exposure based on the trend, can help investors navigate various market conditions while managing risk and ensuring participation in long-term uptrends. As with any investment product or strategy, investors should conduct thorough research and understand the risks before committing capital.

Get an expertly tailored investment portfolio custom to your needs. Book a free consult to secure retirement income, reduce taxes, and safely grow wealth.

Get an expertly tailored investment portfolio custom to your needs. Book a free consult to secure retirement income, reduce taxes, and safely grow wealth.

Copyright© 2024 Successful Portfolios. Powered by PressGo Digital