Ten years ago, we first posted about wide moat investing. Since then, a booming stock market has created remarkable wealth for many investors. Here’s an update.

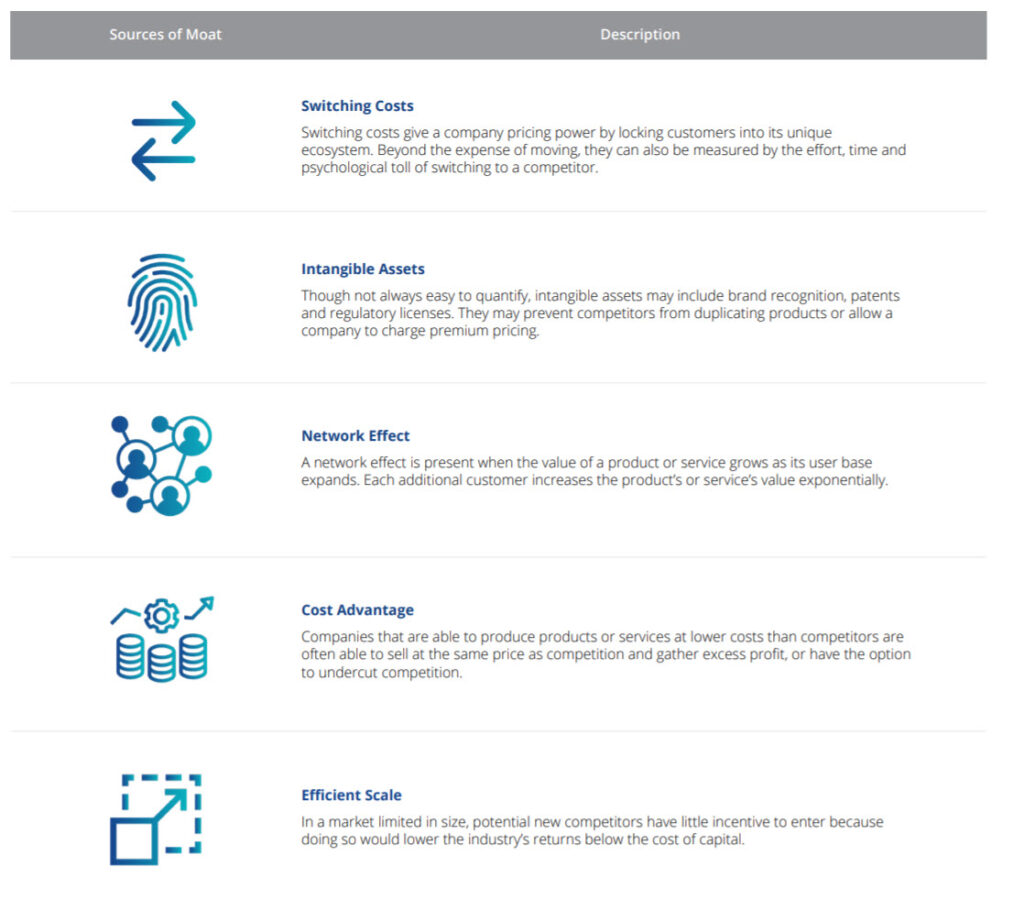

Today, VanEck sponsors three ETFs focused on picking stocks using Morningstar’s moat methodology. The tickers are MOAT, MOTI, and GOAT. Clever! The image below is an excerpt from “What Makes a Moat – Morningstar Five Sources of Moat,” a recent white paper by Van Eck.

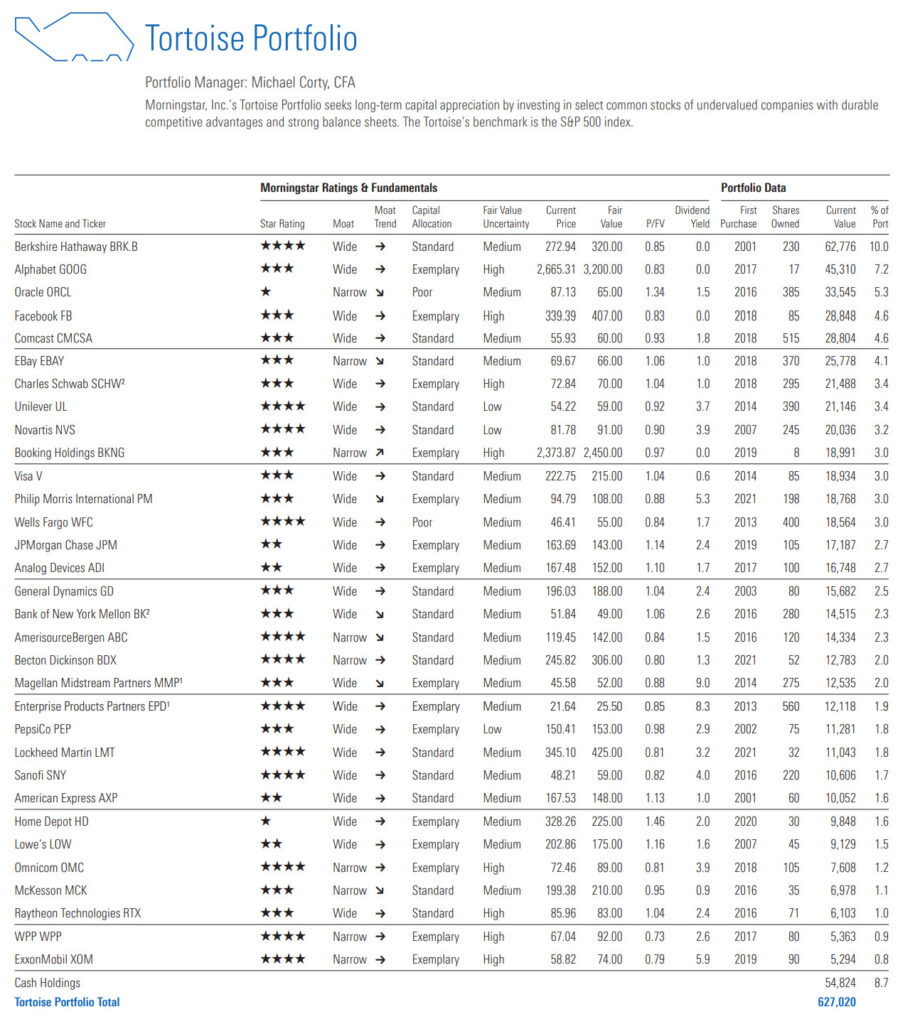

Morningstar StockInvestor is a monthly newsletter focused on wide-moat stock investing. Wide moat investing is a strategy that seeks to invest in companies with stable or growing competitive advantages, aka “moats.”

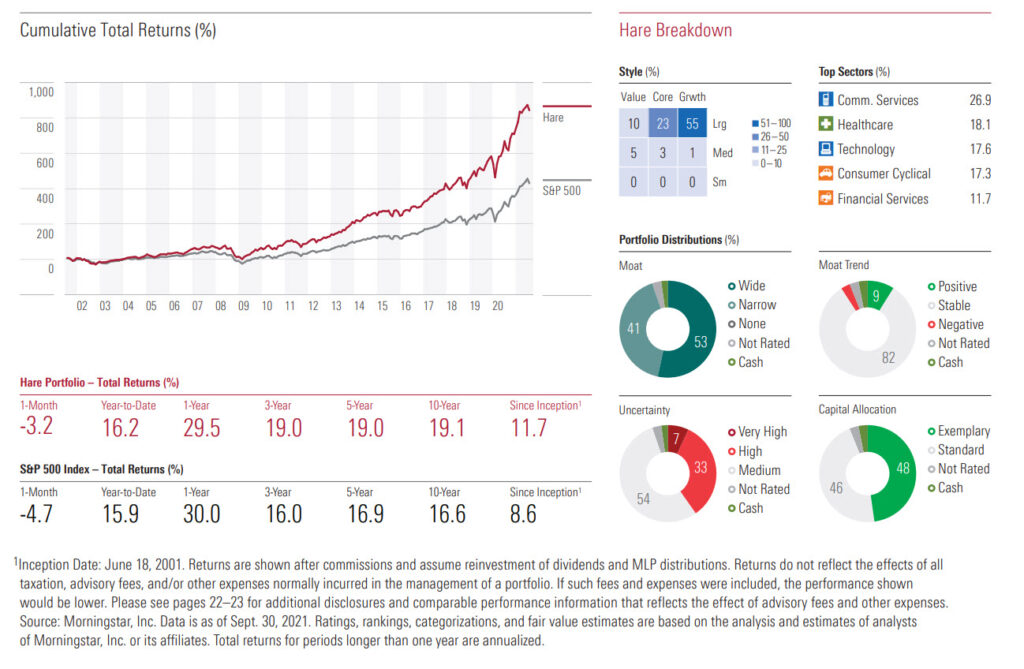

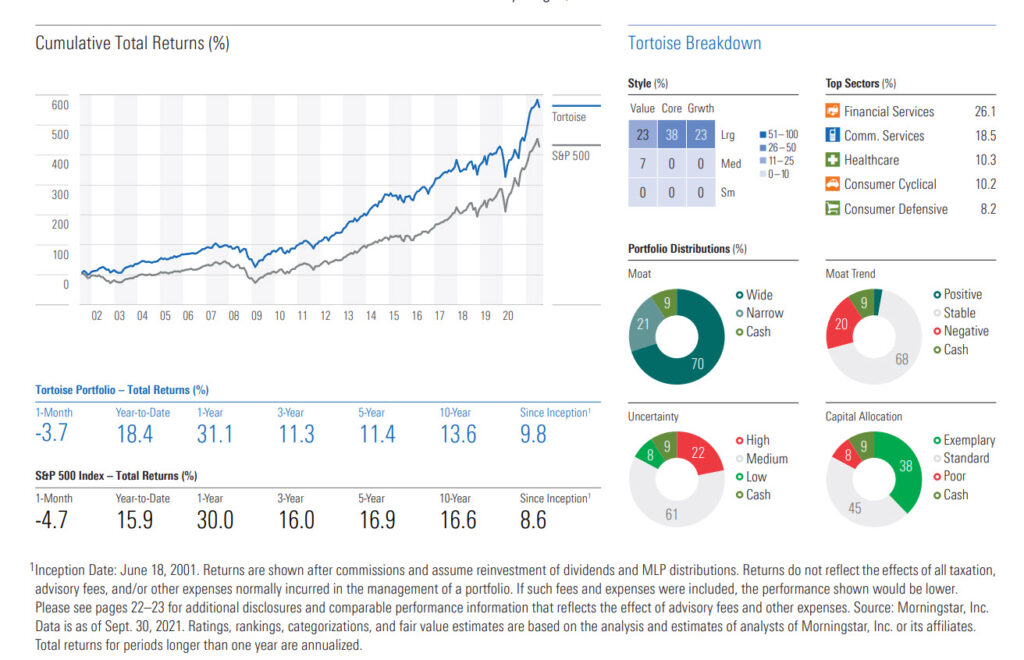

Below are the historical returns on the Morningstar Hare and Tortoise Portfolios, as shown in a recent issue of StockInvestor.

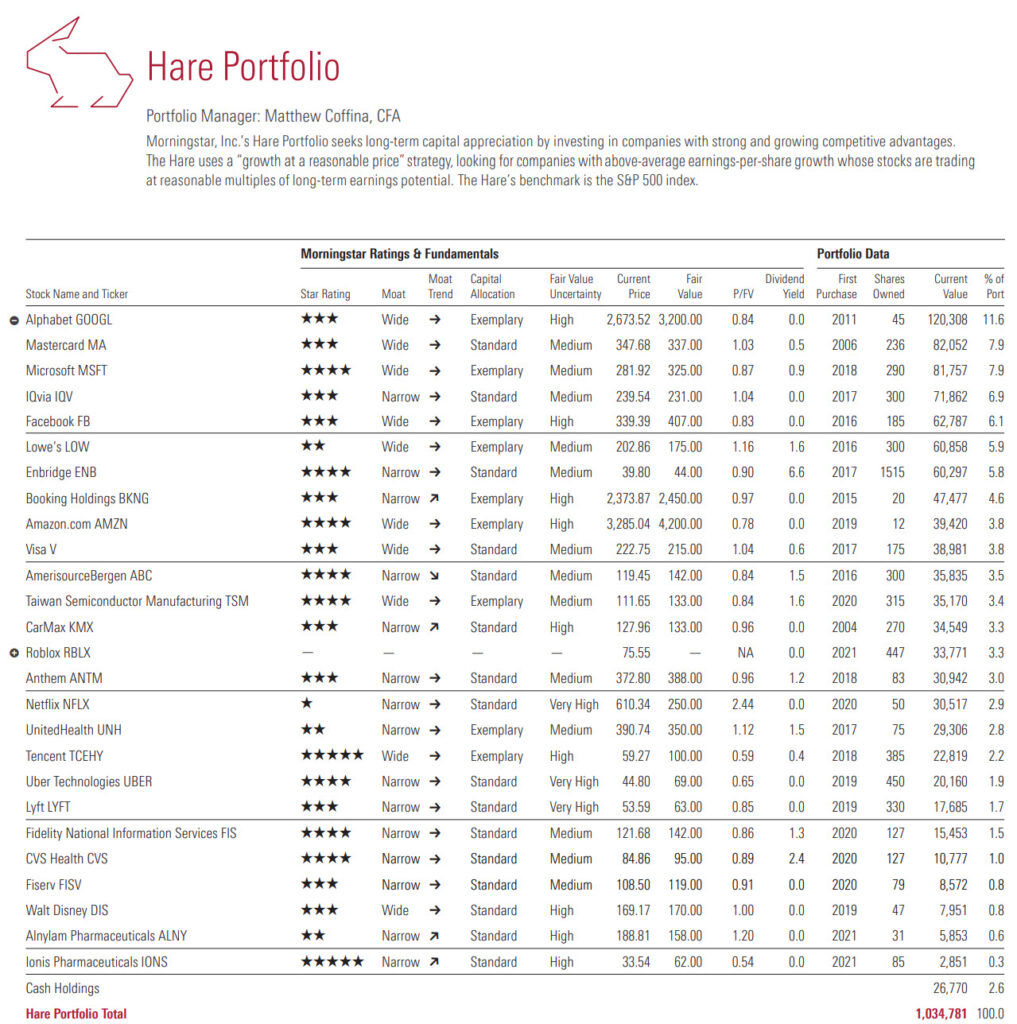

Historic portfolio turnover is low for Hare and Tortoise. Low turnover is a desirable attribute boosting returns all else equal. Below is a recent snapshot listing each portfolio’s holdings and relevant metrics.