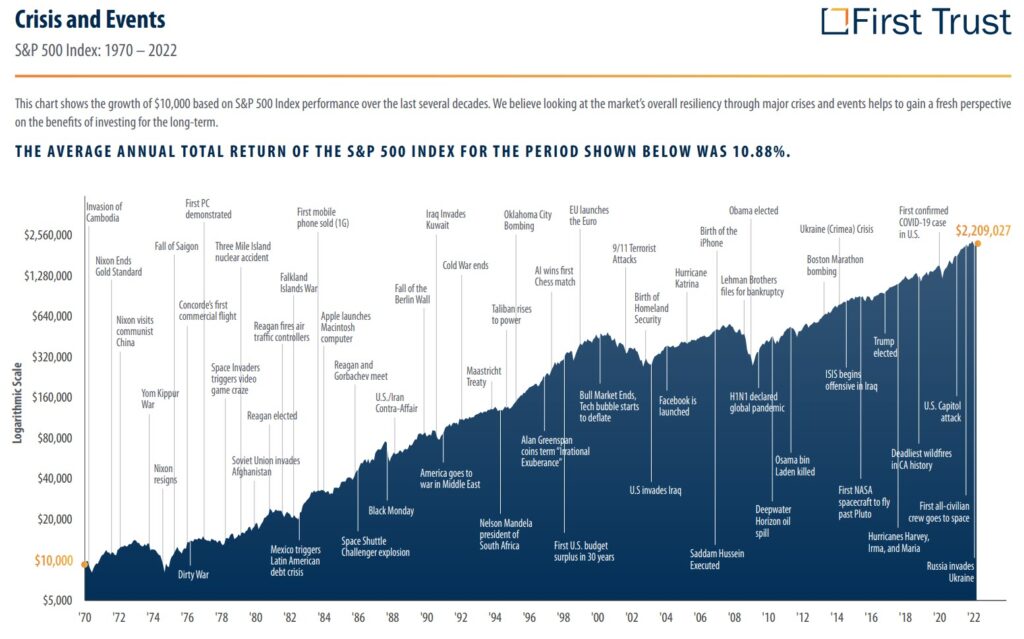

[vc_row][vc_column][vc_column_text]The case for buy and hold investing is illustrated in two infographics shown below. Digest the past fifty years of stock market ups and downs amidst news, noise, crisis, war, and recession. Then save and invest in the stock market. Hold for the long term. Here’s how $10,000 grew to $2.2 million.

Link to “Stocks for the Long Run” on Amazon

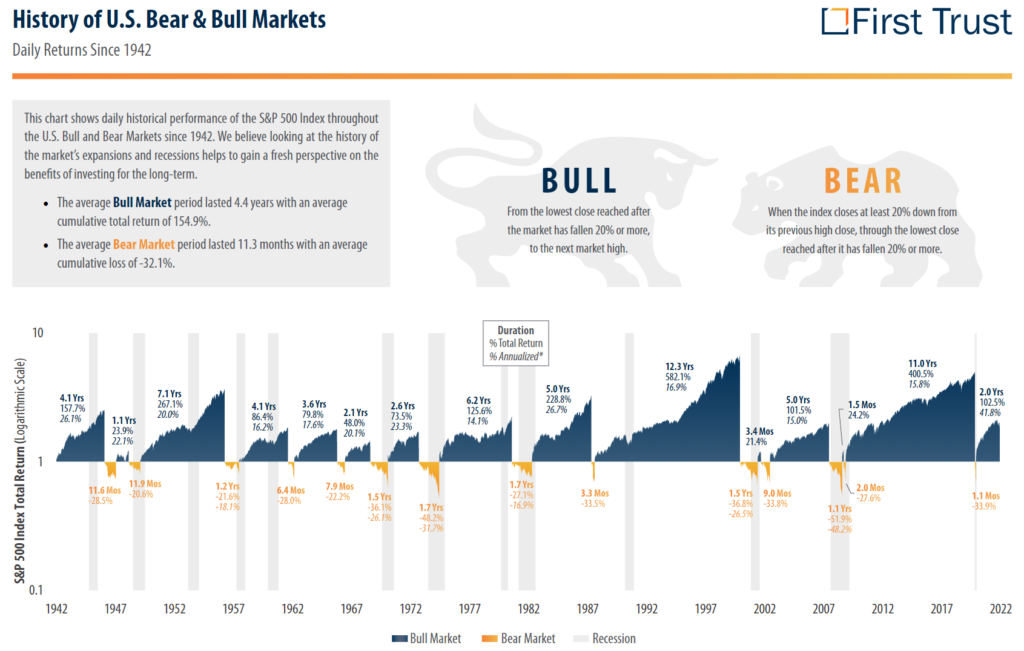

Of course, investors can and do lose money in the stock market. Remember that bull and bear markets are inevitable. Selling everything at a market trough is a severe mistake and a risk you’ll want to avoid.

Next, It’s Worth Remembering This Quote…

The worst course an investor can take is to follow the prevailing sentiment about economic activity. The reason is that it will lead the investor to buy at high prices when times are good, and everyone is optimistic and sell at the low when the recession nears its trough and pessimism prevails. The lessons to investors are clear. Beating the stock market by analyzing real economic activity requires a degree of prescience that forecasters do not yet have. Turning points are rarely identified until several months after the peak or trough has been reached. By then, it is far too late to act in the market. —Professor Jeremey J. Seigel

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

In Conclusion, Here is Why Buy and Hold Works

One of the best arguments for buy and hold investing in the stock market is that it allows investors to benefit from the power of compounding. Compounding means that the returns on an investment are reinvested and generate more returns over time. This way, investors can grow their wealth exponentially without having to trade or time the market constantly. Buy-and-hold investing also reduces the costs and risks associated with frequent trading, such as commissions, taxes, and volatility. By holding stocks for the long term, investors can avoid emotional decisions based on short-term fluctuations and focus on the fundamentals and prospects of the companies they own. Buy-and-hold investing is a simple and effective strategy that has proven to outperform most active trading strategies in the long run.[/vc_column_text][/vc_column][/vc_row]