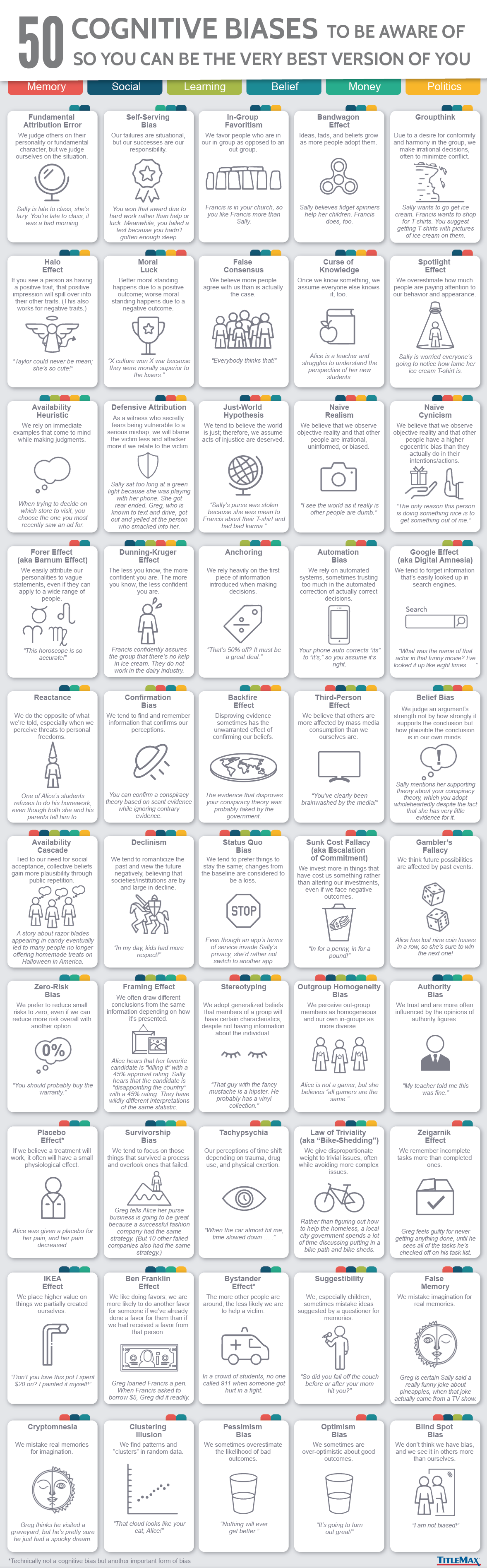

Learn These Fifty Cognitive Biases and Investor Mistakes

Learn to avoid common investor errors and improve your investment results. Study the cognitive biases and mental errors shown in this chart!

SOURCE: — A Tweet by Elon Musk (@elonmusk) December 19, 2021

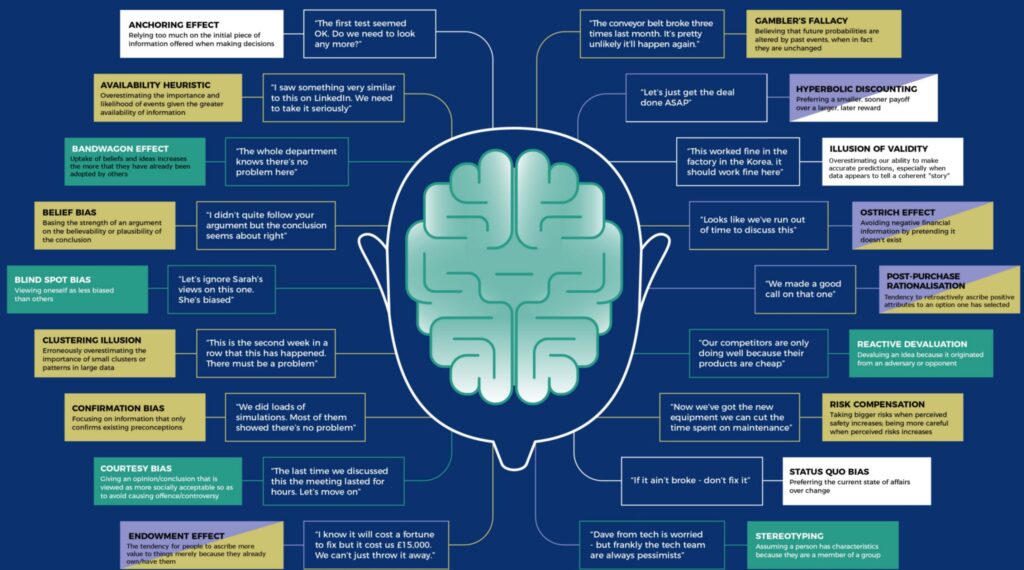

Now read this Bonus Infographic Illustrating Mental Errors Often Made by Investors

Next, check out these factoids from a CFA Institute Refresher Reading on the Behavioral Biases of Individual Investors

- Investors do not always act rationally, a result of behavioral biases.

- Mental biases can lead to bad decisions and mistakes.

- Behavioral biases are either cognitive errors or emotional biases. A given bias may have aspects of both.

- Cognitive errors stem from statistical, information-processing, or memory errors.

- Emotional biases stem from impulse or intuition. Investor feelings matter.

- Cognitive errors are easier to correct.

- Emotional biases are harder to correct because feelings are difficult to change.

- To adapt to a bias is to recognize, accept, and adjust for the bias.

- To moderate a bias is to recognize the bias and attempt to reduce or even eliminate it.

- Cognitive errors come in two categories: belief perseverance biases and information-processing biases.

- Belief perseverance errors reflect an emotional need to maintain beliefs. Belief perseverance is related to the psychological concept of cognitive dissonance.

- Examples of belief perseverance biases include conservatism, confirmation, representativeness, the illusion of control, and hindsight.

- Information-processing biases stem from illogical, irrational processing of information.

- Information-processing biases include anchoring, mental accounting, framing, and availability.

- Emotional biases include loss aversion, overconfidence, self-control, status quo, endowment, and regret.

- Understanding and detecting biases are the first steps in overcoming their effect on financial decisions.

- Behavioral finance may explain deviations from efficient markets and market anomalies.

In the end, remember it is possible to counter biased thinking. Seek and understand multiple perspectives and opinions. Asking a professional advisor for input can help you find blind spots and avoid overconfidence. Call or text Successful Portfolios today at (727) 744-3614. Our team of Certified Financial Planners and Chartered Financial Analyst pros is ready to help you make better investment and financial planning decisions.