ETF Worksheet For 2024

If you’re looking for a smart way to invest your money, exchange-traded funds (ETFs) might be your best bet. These investment vehicles offer a hassle-free and cost-effective way to access a diverse range of assets, including stocks, bonds, and alternative investments.

Core-Satellite Investment Strategy

When it comes to achieving your financial goals, diversifying your portfolio, reducing costs and taxes, and potentially outperforming the market, the core-satellite investment strategy is worth considering. This strategy combines passive and active investing techniques, including thematic investing and stock picking, to optimize your portfolio’s performance. However, the value of collaborating with a well-qualified fiduciary advisor cannot be overstated. While DIY investing can be tempting, working with an experienced professional provides invaluable guidance and support.

A Systematic Approach to Trend Following: Pacer Trend Pilot ETFs

Trend following is a popular trading strategy that seeks to capitalize on market movements in a specific direction over time. Instead of attempting to predict future price levels, trend followers adjust their positions according to the current trend. The Pacer Trend Pilot ETFs offer a systematic approach to trend following using a rules-based methodology to switch between equity and treasury exposure based on the trend’s strength. This approach seeks to reduce risk by selling stocks when the market declines.

Why Invest in Gold without a Bullion or Coin Dealer?

Investing in gold has long been considered a safe haven and a hedge against inflation. However, when it comes to purchasing gold, investors face the choice between buying physical gold from coin or bullion dealers and investing in gold ETFs through a Registered Investment Advisor (RIA) like Successful Portfolios. In this blog post, we’ll explore the benefits of choosing a gold ETF with the help of Successful Portfolios over physical gold and why it may be the more intelligent choice for your investment portfolio.

Top 20 Core ETF Pick List

Get our Top 20 Core ETF pick list. Ultra-low-cost, liquid, and easy to trade. Simple capitalization-weighted stock and bond ladder portfolios. Create a custom, no-nonsense capital markets ETF portfolio. Our picks include exchange-traded funds managed and sponsored by Vanguard, Blackrock iShares, State Street SPDR, and Charles Schwab.

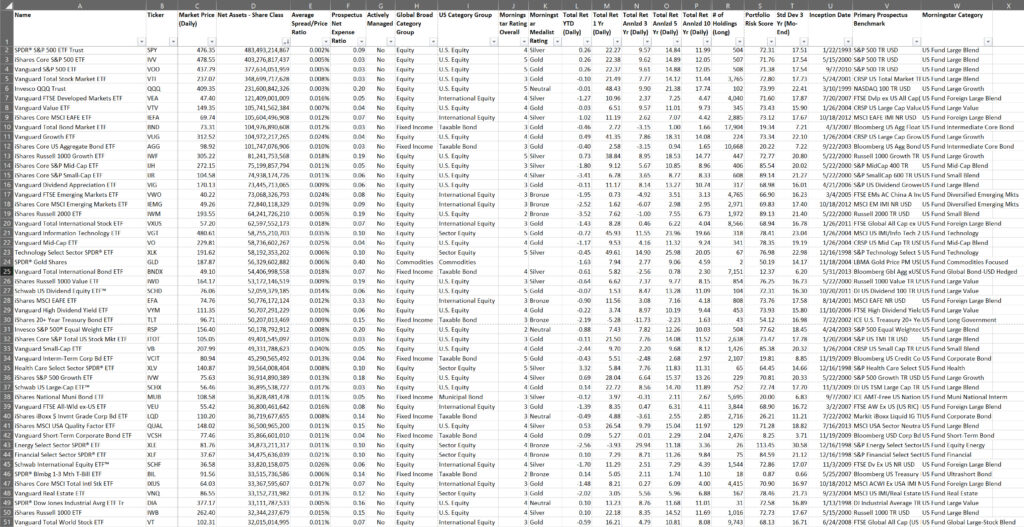

ETF Picklist – The Only Investment List You’ll Ever Need

Our ETF picklist could be the only investment list you’ll ever need. Get sortable, quality data on over 250 top-rated Exchange Traded Funds. Download the Excel worksheet for free from Successful Portfolios.

Vanguard ETF Strategic Model Portfolios

The Vanguard ETF Strategic Model Portfolios, including the Core Series, are available to clients of Successful Portfolios LLC, an SEC Registered Investment Advisor. The Core Series Model earns the highest possible rating by Morningstar.

BlackRock Target ETF Model Portfolios

The BlackRock Target ETF Model Portfolios are available to clients at Successful Portfolios LLC, an SEC Registered Investment Advisor. The Models earn Morningstar’s highest rating. See the recommended allocations.

Wide Moat Investing Revisited

Wide moat investing works. Competitive advantage matters. Ten years ago, we first posted about wide moat investing. Since then, a booming stock market has created remarkable wealth for many investors. Here’s an update.

Top Ten Highest Quality Stocks in the USA

Here’s a list of what is arguably the top 10 highest quality stocks in the USA as of August 24, 2021.