Learn the Secret – Immediate Annuities

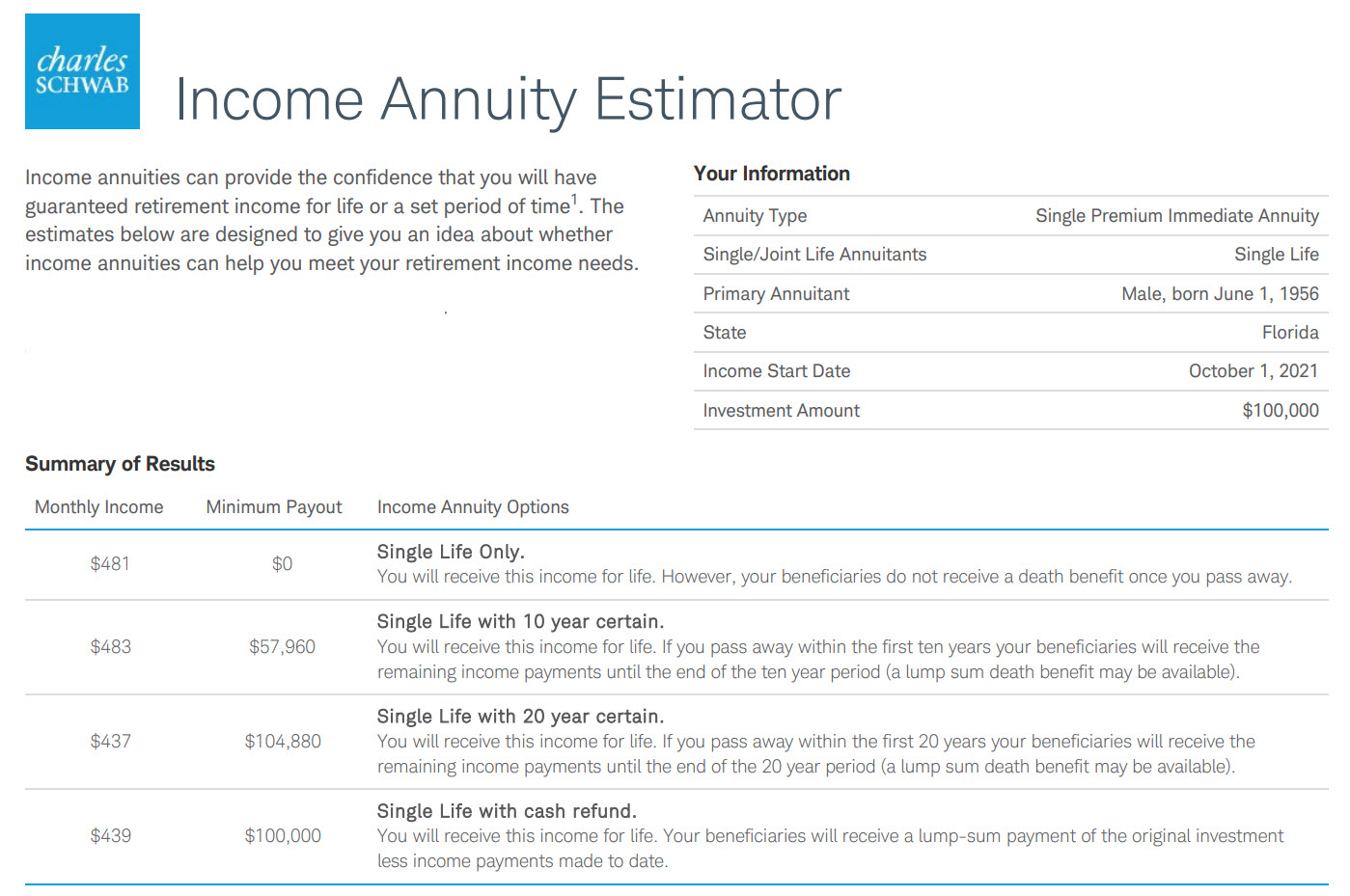

Immediate Annuities – An immediate lifetime annuity is a low-margin product for insurance companies. A simple life annuity is a fungible good sold in a competitive market. For similar contract terms, you will find little difference in rates between insurers. By the way, you can check out the Income Annuity Estimators at Schwab and Fidelity and see for yourself. But read on before you commit to parting with your money.

Consider the current market immediate annuity estimate illustrated below. A 65-year-old male that invests $100,000 in a single premium immediate annuity would receive a payment of about $481 per month for the rest of his life from the issuing insurance company. That’s an income of $5,772 per year until death. This is a simple, straightforward contract for the owner-annuitant. And it indeed provides income that the owner can’t outlive. But there’s at least one significant drawback- you might lose money!

And beware, life insurance companies and agents sell annuity contracts far more complex than our example. And this can be to the detriment of the consumer. That’s a fact you need to know and remember. You also might be wondering…

What’s the Rate of Return on an Immediate Annuity?

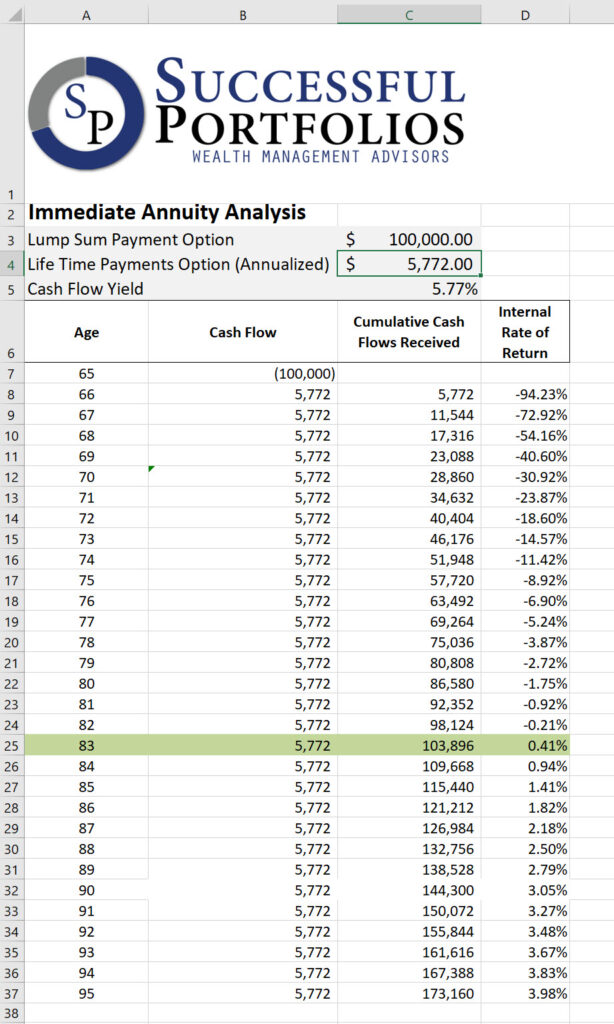

A simplistic answer is to divide the annual payment by the premium paid. In the example illustrated above, that would be $5,772 / $100,000, equal to 5.72%. In today’s low-interest-rate economy, that sounds pretty good, right? Well, not so fast. The key feature you must understand about a single-life immediate annuity is that no more money will be forthcoming from the insurer upon the annuitant’s death. So, if an annuitant dies sooner rather than later, he loses money. Consider the annuity return table shown below.

Download the Excel file.

As you can see, our 65-year-old annuitant must live until age 83 before he makes a profit on his immediate annuity contract. If he lives to age 95, he will have earned a 3.98% return on his money. Pretty good! But it is less than the simplistic 5.77% cash flow yield often quoted by insurance agents.

We recommend you consult with the Fee-Only Certified Financial Planner (CFP) pros at Successful Portfolios. This is a must-do before you buy an agent-sold immediate annuity or other complex annuity contract. We promise to give you a professional opinion often different than what you’ll hear from a commission-paid agent. Satisfaction Guaranteed!