A protective put option can help protect your investment portfolio from a stock market decline.

What if you have a strong hunch that the stock market is about to drop? Should you sell all your stocks? No. But buying a protective put option can be a sensible strategy when a stock market decline appears imminent.

Selling all your stocks is risky. After all, your stocks might go up after you sell. Then you’d lose out. But with a protective put, you retain upside potential if stocks go up.

Moreover, selling your stocks could trigger adverse tax consequences if you have significant gains in your portfolio. A protective put has tax advantages relative to liquidating stocks.

Watch the video below and talk with the pros at Successful Portfolios – Parker, David, or Joe. Our advisors know the ins and outs of trading put and call options, protecting profits, and managing risk and return. They’d be happy to help you.

[/vc_column_text][vc_separator][/vc_column][/vc_row][vc_row][vc_column][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][vc_separator][/vc_column][/vc_row][vc_row][vc_column][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

Now download and read Characteristics and Risks of Standardized Options.

Call or Text the Option Pros at Successful Portfolios: 727-744-3614

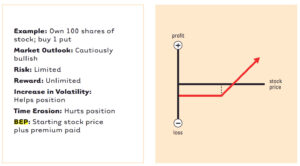

Protective Put Option Payoff Diagram

Think of a protective put option as a form of portfolio insurance. A long put creates a floor under the price of an asset, be it your portfolio or a single stock. Put options on $SPY, the SPDR S&P 500 ETF are an excellent vehicle to hedge a portfolio with a high correlation to the S&P 500 Index.

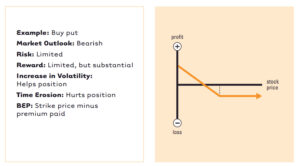

Speculative Long Put

A speculative long put option is a simple wager that a stock not owned by the put buyer will decline.