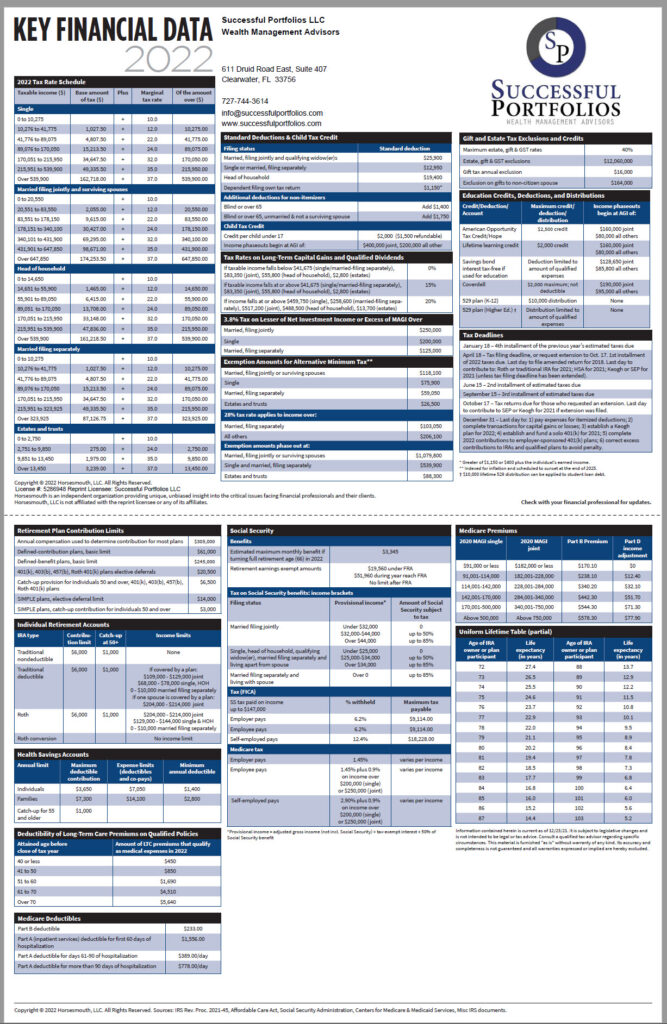

Download the Key Financial Data and Tax Fact Sheet 2022.

Our handy two-page fact sheet (pdf) is a must-have planning tool for all taxpayers.

- Tax Rate Schedules and Brackets for all Filing Types

- Standard Deduction and Child Tax Credit

- Tax Rates on Long-Term Capital Gains

- Tax Rates on Qualified Dividends (QDI)

- Affordable Care Act (ACA) 3.8% Tax, aka The Obamacare Tax

- Alternative Minimum Tax

- Gift and Estate Tax Exclusions and Credit

- Retirement Account Contribution Limits (IRA, 401(k), etc.)

- Social Security and Medicare Tables

Get the IRS Form 1040 Instruction for 2021

Let our team help you plan and minimize your taxes using the information in the Tax Fact Sheet 2022. Call (727) 744-3614.