How to Plan a Secure Retirement

Planning for a Secure Retirement Planning for secure retirement can sometimes feel like navigating through a maze. Everyone dreams of a comfortable and secure retirement, but the journey is often filled with financial uncertainties. Decisions about current and future income, expenditures, taxes, and estate planning can seem overwhelming. Furthermore, the unpredictability and volatility of the […]

Monte Carlo Retirement Calculators: Navigating the Future with the Flexible Retirement Planner

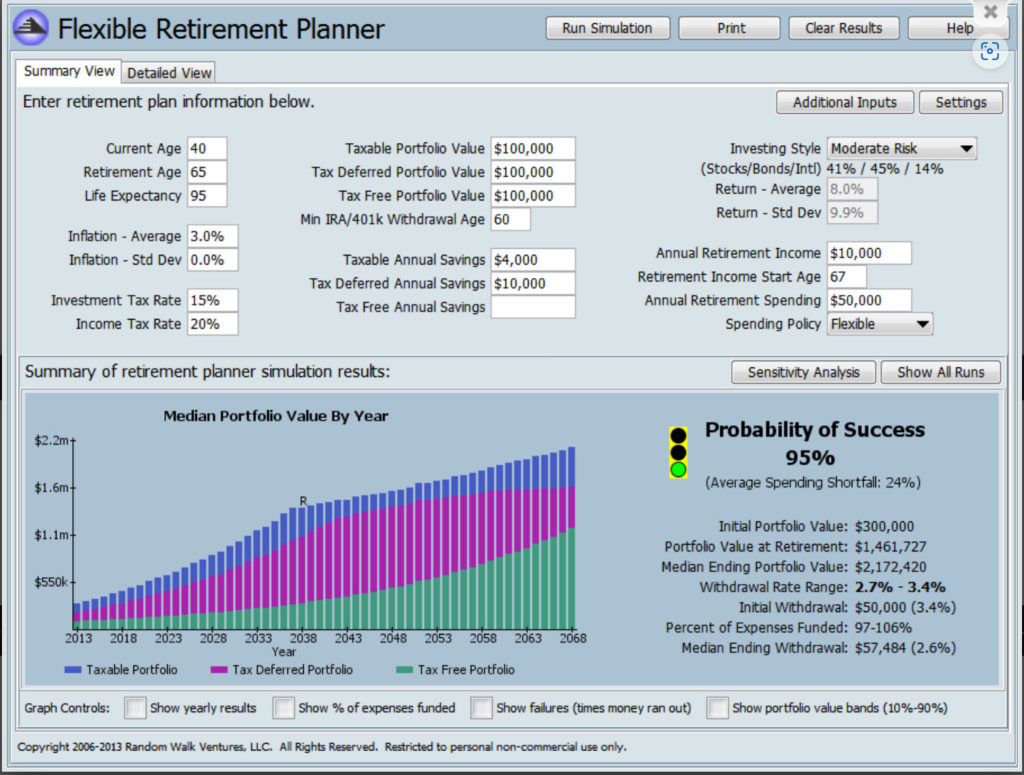

Monte Carlo Retirement Calculators: Navigating the Future with the Flexible Retirement Planner Retirement planning, in its essence, is a voyage through time. As you glance at the visual showcasing The Flexible Retirement Planner interface—with its promising ‘95% chance of success’—you’ll get a glimpse of how modern tools can simplify this voyage. Throughout this article, we’ll […]

Your Guide to Individual Investment Policy Statements (IPS)

Investment Policy Statements (IPS) have long been considered a key component of managing institutional portfolios. However, individual investors often overlook the importance of establishing a comprehensive IPS to guide their personal investment decisions. Recognizing this gap, the CFA Institute’s “Elements of an Investment Policy Statement for Individual Investors” is a valuable resource for those looking to create a structured and disciplined approach to managing their investments.

Retirement Planning

Planning for retirement can sometimes feel like navigating through a maze. Decisions about current and future income, expenditures, taxes, and estate planning can seem overwhelming. Furthermore, the unpredictability and volatility of the financial markets can add to this stress. So, how can you secure a financially stable and enjoyable retirement?

How Our Certified Financial Planner (CFP) Pros Help You Reduce Taxes in Retirement

Retirement planning can be a complex process. Minimizing your taxes in retirement isn’t easy. Our Certified Financial Planner Professionals can help you navigate the tax landscape and ensure you’re making the most of your retirement nest egg. Intelligent tax planning requires optimal sequencing of deposits and withdrawals from qualified accounts and knowing when to claim social security benefits. Be sure to download our free Key Financial Data 2022 Fact Sheet at the end of this post for quick reference on current tax brackets and other vital financial information.

Tax Fact Sheet 2022 with Key Financial Data

Download the Key Financial Data and Tax Fact Sheet for 2022. Our handy two-page factsheet (pdf) is a must-have reference and planning tool for all taxpayers.

Vanguard ETF Strategic Model Portfolios

The Vanguard ETF Strategic Model Portfolios, including the Core Series, are available to clients of Successful Portfolios LLC, an SEC Registered Investment Advisor. The Core Series Model earns the highest possible rating by Morningstar.

IRA-Based Retirement Plans for Employers

Here is a simple, easy to digest, table outlining the various IRA-Based Retirement Plans available to small employers, including the self-employed. IRA-based plans are low-cost and easy to administer for employers. These plans have the potential to save owners thousands of dollars in income taxes. Download Source File.

Immediate Annuities – What You Need to Know But Agents Won’t Tell You

It’s true. An immediate annuity can provide dependable income that the owner-annuitant can’t outlive. But there’s at least one significant drawback- you might lose money! Read on to learn more about the pros and cons of immediate annuities.

Rescue Your Stranded Retirement Accounts- IRA Rollover Account

Now’s the time to rescue, roll over, and consolidate your retirement accounts stranded at your previous employers. This includes 401(k), 403(b) TSA, TSP, 457(b), etc. Here are five reasons why an Rollover IRA makes sense.