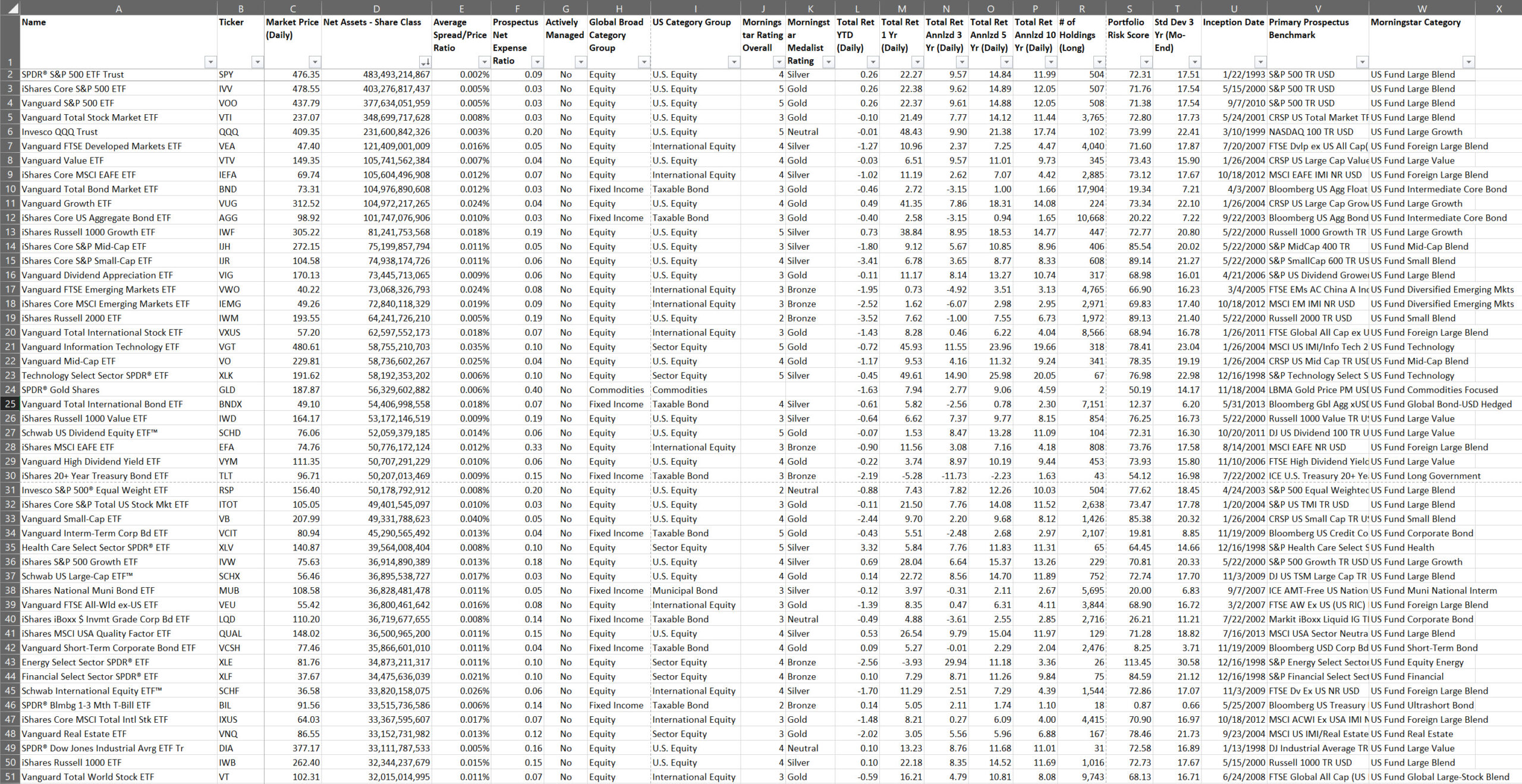

ETF Worksheet For 2024

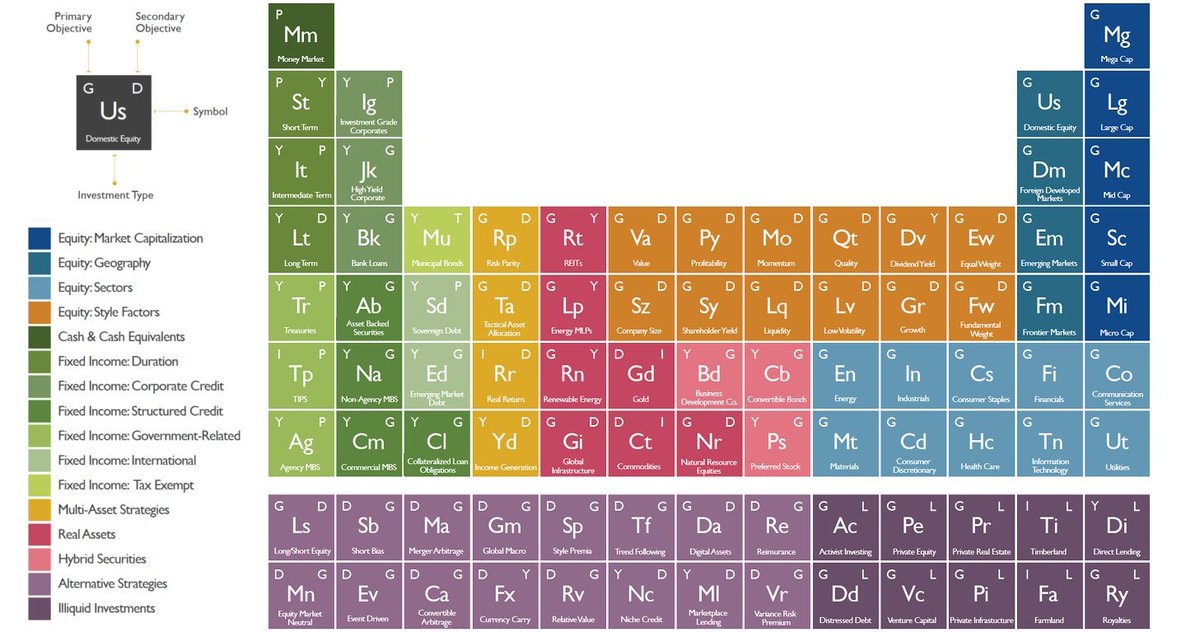

If you’re looking for a smart way to invest your money, exchange-traded funds (ETFs) might be your best bet. These investment vehicles offer a hassle-free and cost-effective way to access a diverse range of assets, including stocks, bonds, and alternative investments.