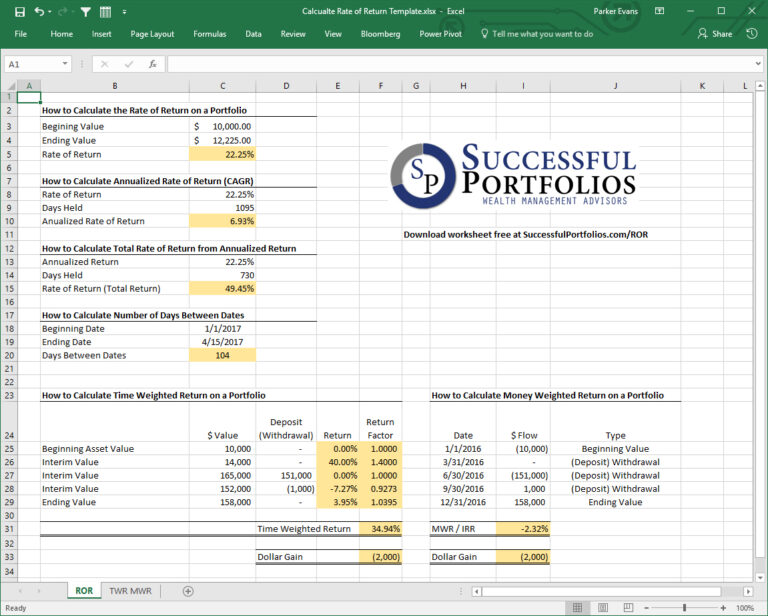

With our free, easy-to-use rate of return worksheets, you can use Excel to learn how to calculate the Rate of Return (ROR, TWR, MWR, Rule of 72, FV) on your investment portfolio. Here’s what you can learn to calculate:

Download the Rate of Return Worksheet.

Download the Rate of Return Worksheet.

TWR and MWR are identical unless there are interim deposits and withdrawals. Size matters. Timing matters. Many investors don’t understand the various methods and tools used to calculate return on investment. With our free Excel template, you can calculate various return measures for a stock, bond, mutual fund, ETF, other asset, or portfolio. Successful Portfolios insightful and educational rate of return worksheet is available for instant, free download.

Now read How to Calculate the Internal Rate of Return on an Annuity or Pension.

P.S.,

Get the “Rule of 72” rate of return worksheet download.

Get an expertly tailored investment portfolio custom to your needs. Book a free consult to secure retirement income, reduce taxes, and safely grow wealth.

Get an expertly tailored investment portfolio custom to your needs. Book a free consult to secure retirement income, reduce taxes, and safely grow wealth.

Copyright© 2024 Successful Portfolios. Powered by PressGo Digital